Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

I get the hype around Bitcoin and blockchain technology. The notion of an unregulated, fee free, community-based network sounds great. The problem is people will always misbehave. It is human nature. Even more importantly, governments need to track payments so that they can gather taxes. No one likes paying taxes, but they are very necessary. Yesterday India expressed a will to regulate cryptocurrencies. Can you blame them? They have been working exceptionally hard to eradicate a cash based society in order to track payments and raise taxes. If Bitcoin went mainstream with no regulation, then that would have been in vain.

Visa reported earnings last night which looked fantastic. In a way, Visa aims to achieve the same goals as cryptocurrencies. They provide an easy, trustworthy and efficient medium of exchange. Of course they do not do it for free. But why should they? They are offering an exceptionally useful product. The difference here is that regulators love Visa! Swiping plastic can be tracked through the banks. Tax evasion is bad for economies and most notably, the vulnerable people in society. Governments ability to track payments is a good thing.

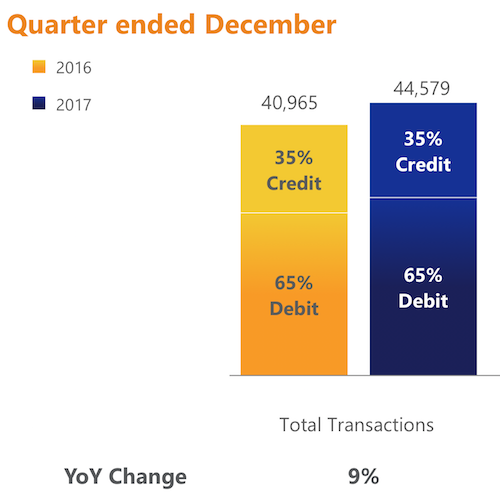

Ok, let's look at the Q1 numbers. Net revenues grew 9% driven by strong international revenue. Total payment volume increased 12.4% in constant currencies to a whopping $2.030 trillion. International (outside the US) grew volumes by 15.2%. This is good news as the developing markets start adopting plastic transactions. The picture below shows how many transactions took place using Visa cards and with what cards.

Earnings came in at $1.08, well ahead of expectations. The company expects earnings for the full year to increase by more than 20%, helped by a $7.5bn share buyback program. Earnings for the full year are expected to come in at $4.40. The stock trades at 28 times earnings which may sound expensive but remember they have operating margins of 68% and are growing earnings north of 20% per annum.

There are so many tailwinds for this business. I already mentioned the regulatory environment but consider the changes in the way we consume. Uber, online retail, app-based rewards programs, music streaming services, video streaming. They all support credit card payments. We continue to add to Visa as a core Vestact holding.