Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

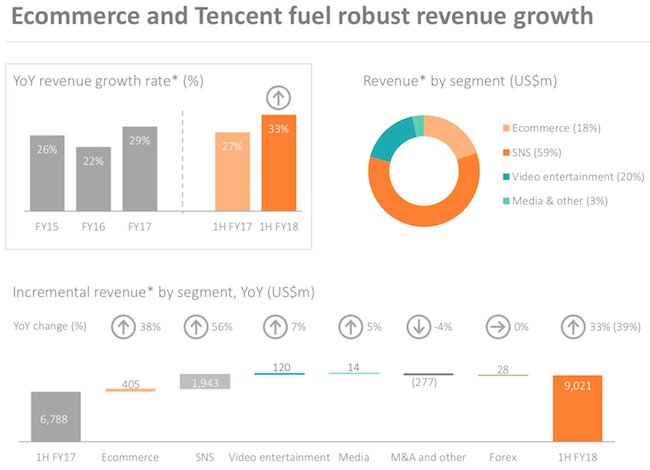

Last week we received interim 6 month results from Naspers. Being by far the biggest company on the JSE, this event now attracts a lot of attention. As expected, the results looked stellar on the back of another incredible period for Tencent. Let us take a look at the numbers which remember, are now reported in dollars.

Revenues increased by 33% to $9bn. This resulted in a big leap in core headline earnings per share, up 65% to $3.50. In Rands that equates to R48 a share. Let's assume they grow earnings by a very conservative 10% in the second half. That would mean they would make around R100 a share. Currently trading at R3531 a share, the stock trades at 35 times earnings. I remember a time when Naspers traded at 150 times earnings. Despite the phenomenal rise in the share price, the stock has actually become cheaper related to earnings. People often forget that.

Here is a nice visual of their revenue mix. SNS (social network services) includes Tencent and Mail.ru

We often cover Tencent separately, in light of that I want to focus on the rest of the business.

Ecommerce grew revenues by 15%. This division includes Etail, Travel, Payments, Classifieds and Food Delivery. All areas with great potential, especially in the untapped developing markets. Classifieds (OLX) have just become profitable. Etail which includes Takealot and Flipkart will suck funds for a while to come. That makes sense, building distribution centres and sorting out logistics is capital intensive. We can see how long it has taken Amazon to build scale. But once you have that scale, you are almost untouchable. Flipkart has a 70% market share of online retail in India.

The Ecommerce division used up around $318m whilst the Video Entertainment division made around $234m. They are still using the old profitable video business to fund the new exciting ecommerce division.

Video entertainment had a decent period. Trading profits grew by 4%. The Rand has stabilised to the dollar but many of their operations throughout the continent suffered on the back of weak currencies. Showmax is doing nicely in South Africa and also has a solid presence in Poland. Maybe they got there before Netflix?

All in all these numbers look solid. We are comfortable that the rest of business is on the right track, continuing to grow and become more influential within the massive shadow of Tencent.

The current allegations against Multichoice are upsetting. Their silence on the matter has also been disappointing although they did announce on Friday that they have implemented an internal investigation. As a Naspers shareholder, I wouldn't be too concerned, the rest of the business is far too big and separated to be heavily influenced. As a concerned South African however I will follow this story closely. If the allegations are true, I hope we see some heads roll and the consequences dealt with accordingly.