Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

We have often spoken about how being a pessimist makes you sound smart and being an optimist makes you sound naive. I find this very ironic and somewhat strange on the back of a globe that is constantly improving in so many facets of life. The stats don't lie. Poverty levels have decreased, healthcare has drastically improved and more and people are living better lives. Of course there are a lot of negatives out there that need improving. One of those is the environment.

It has also become very fashionable to beat down on Tesla. If you think Tesla will fail you come across as smart, cautious and articulate. If you believe in the Tesla story you come across as naive and a sucker to the smokes and mirrors that Elon Musk has managed to brainwash you with. That is more recently of course because the share price is down 22% from it's highs of September. To put that into perspective the stock is still up 44% so far this year. So who is actually wrong here? You be the judge.

Let's delve into the Q3 numbers they released a few weeks back and see why the stock has been so volatile.

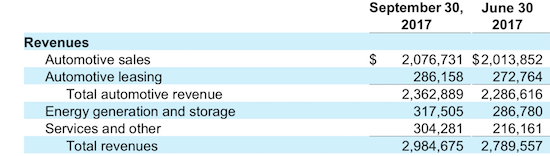

Below is the revenue mix of the business. I have popped this in to show that this company is not just a vehicle manufacturing business, it is also an energy business. Although Energy generation only contributes 10%, it is growing fast. A big power supply agreement in Western Australia is just the start of what can be a very lucrative business.

Services and Other includes sales of second hand Tesla's as well as servicing of the existing ones.

Ok lets look at the vehicle segment. During the quarter they delivered their 250 000th vehicle. They delivered 26 137 vehicles in the quarter. The problem for investors was that only 222 of those were Model 3 vehicles. Elon Musk has promised 5000 a week by Q1 2018 with a potential 10 000 a week shortly after. Wall Street is not so sure. The company experienced some heavy bottlenecks this quarter, mostly with regards to battery assembly. This is why the share price has pulled back.

I understand the market getting a little jittery about failed promises. But this is a real business trying to achieve a very tough task. Soothing Wall Street is not their concern. Amazon went through the same 'yes they can', 'no they can't' seesaw for nearly 5-years before they achieved scale.

Tesla often gets compared to other vehicle manufacturing companies. But it is not just that. It is a utility, a software business and most importantly a battery manufacturer.

When all the other big car companies manufacture electric vehicles where do you think they will come knocking to buy those batteries? Tesla are first movers and have pumped billions into mainstream battery production. Solar and battery power will be a huge part of our future.

Their cars have an amazing allure, similar to Apple. They will continue to attract a premium because they are beautiful, simple and a great product.

Their current issues revolve around supply, not demand. Demand for electric vehicles will be massive for 50 years and more because of the low base it is coming off. Even when the other big vehicle players go mainstream.

Short term "investors" might be concerned about these bottlenecks but if you are patient I believe Elon Musk and his team will succeed. They have already achieved the impossible in a short space of time. As you can see, it is volatile but continue to hold tight.

As a side note, Elon Musk is making a very exciting announcement today about the Tesla Semi Truck. Jeepers he likes to keep his hands full. Rumour has it that these electric trucks will be able to follow each other like a train with only one driver needed to operate the first truck. Sounds amazing!