Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Many people do not know Priceline. The name of the of the company is not synonymous with it's strongest brands. In reality, this is an $80 billion online travel booking behemoth. Who better to explain what they do than the company itself. The following comes from their latest results report.

Incredibly, out of the brands mentioned above, 88% of Priceline's profits come from outside of the US Expedia (a competitor) is the biggest US player. Booking.com is Priceline's largest brand with nearly 1.5 million listed properties. The company reported third-quarter results yesterday which were horribly received by the market. The stock fell 13.5%, ouch. Let's take a closer look.

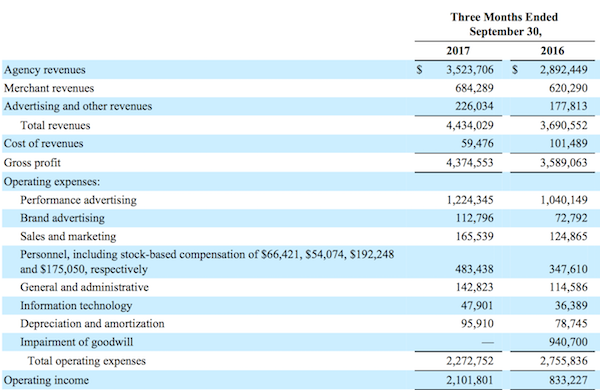

Agency revenues are travel related transactions where the group does not facilitate the payment. For example, if your guest books a hotel room via booking.com but pays directly to the hotel.

Merchant Revenues are derived when the payment is actually facilitated by the group.

Advertising and other revenues are derived mostly from KAYAK which is big referral system used by travel agents. OpenTable the restaurant booking service is included here.

The numbers were pretty good and beat expectations. Bookings increased by 19% to $22bn. Room nights increased 19%, while gross profits increased 22%. Earnings for the full year are expected to come in at $71 a share. That puts the stock at 23.5 times earnings after the share price drop. Not expensive at all for a fast growing tech stock with low capital costs and high profits.

Why did the share price fall so much then? It all relates to costs going forward. Sound familiar? I remember when Facebook shares fell heavily last year when management stated that margins would come down because of reinvestment in the business. Short term "investors" are fickle.

As you can see from the numbers above, their biggest cost is advertising. A vast majority of that actually goes to Google. Priceline is trying to take on Airbnb in the smaller home market. The problem with this market is that there are fewer rooms per advert. One advert for a 500 room hotel covers 500 rooms. An advert for an exclusive guest house with three rooms, will cost the same but result in fewer bookings. Priceline plans on spending big on advertising to continue growing their business; this will include TV commercials in over 30 countries in 2018. Those increased costs, pushed forward earnings guidance down and is why the share price took so much heat.

We see this short-term pullback as great buying opportunity into a world class business.