Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

It was a good year for Apple according to the stock market. The share price is up 60% from precisely 1-year ago. When those full-year results were released in November 2016 there were big concerns about a lack of innovation and how the jewel of the crown, the iPhone, was losing its shine. On the 2nd of November this year Apple released its full-year numbers for the year ending 30 September 2017, which painted a very different picture to these "expectations" from a year ago.

It sure was a busy year. Sales in China were disappointing, however everywhere else seemed to flourish. A stronger dollar had a negative impact on the numbers. Numerous fines and legal battles also took its toll on the biggest listed company in the world. The company announced an increase in its capital return program to $300 billion through to March 2019. Share repurchases will be responsible for $210 billion of that.

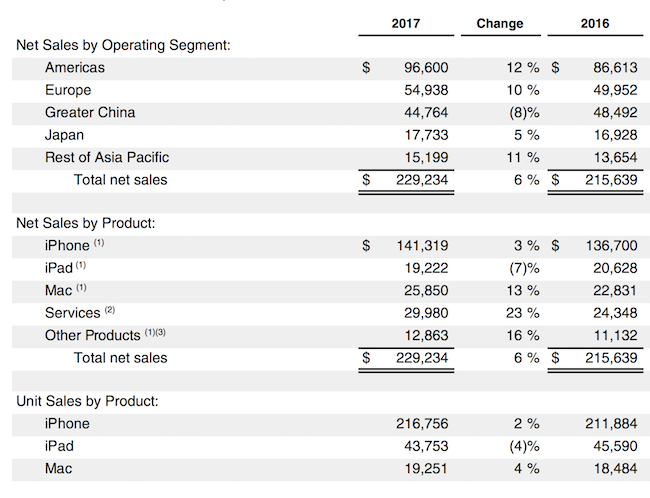

Sales increased by 6% to $229 billion. The graphic below shows you the geographic and product mix of these sales.

As you can see, sales in the Americas were solid (42% of sales), China not so much. Africa doesn't even get a mention. The iPhone was stable (nearly 217 million units sold) while 'services' and The Mac had a great year. The Other Products division which includes the watch also showed good progress.

From those $229 billion in sales the company made an incredible $48.4 billion in net income. Those margins are juicy! This equated to earnings per share of $9.27. Next year that number is expected to rise to $11.50. Trading at $175 a share, the stock trades at 15 times forward earnings. That is well below the market average, even before you consider the $260 billion in cash they are sitting on.

That was the year gone by, what does the future hold for Apple? The hype over the iPhone X is as heated as ever. Expect record sales when these go mainstream into the festive season. That vital part of the business is in good hands.

I am also excited about the services business that is slowly becoming more influential. Music, tv shows, movies, games, apps. That world is enormous, and Apple has over 1 billion activated devices in circulation with access to these services.

The watch also has huge potential. I am looking forward to seeing all the health benefits they can implement into that wearable device. There is still a long way to go to bring the watch up to standard, but we can afford to be patient while Apple churns out billions in its other divisions.

The Mac continues to steal market and profit share. Even more crucial is that it keeps bringing more people into the Apple network. Once you are in, it is hard to leave.

The future looks bright for this incredible company. Even after a 60% rise in the share price, we see massive value in the stock. This is a must-have in every portfolio.