Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

A few days ago, I was watching a Bloomberg interview of one of my favourite Professor Entrepreneurs, Prof. Scott Galloway. They asked him about his new book The Four, Or How To Build A Trillion Dollar Company and his thoughts on Amazon. Below is what he had to say about the company, and here at Vestact we kinda liked what he had to say because Amazon is one of our biggest holding for our offshore portfolios.

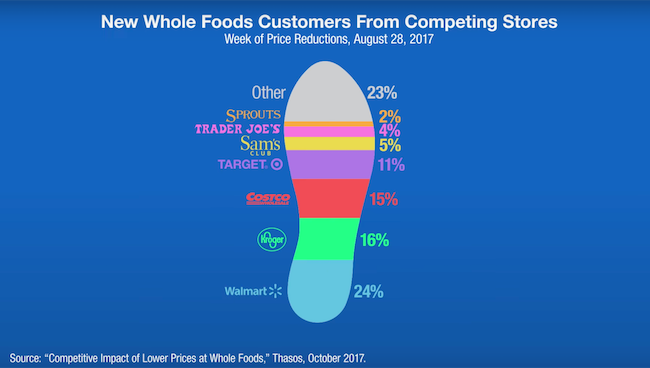

Supermarkets in the U.S. are declining fast at the hands of the Amazon and Whole Foods tie up. Foot traffic to Whole Foods has increased tremendously, up 17% year-on-year following the acquisition. Here is the split of where they're stealing the customers from.

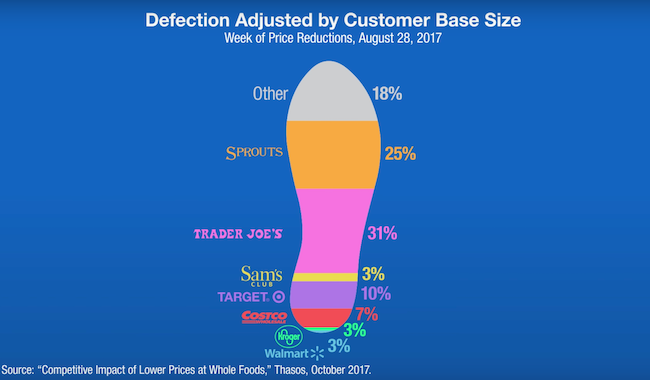

However, if you control for the size of the competitor, Trader Joe's and Sprouts were clearly the losers.

Amazon is not just stealing foot traffic they are disrupting the grocery market. The past few months have shown that they're masters at storytelling and have found different ways to rise to the top in markets they play in. When Nike announced it was going to start distributing on the Seattle Giants website, its shares were up 2% on the day, compared to shares of traditional sports retailers like Footlocker, Finish Line, Dicks Sporting Goods tumbled.

On the 6th of this month when Amazon announced they might be entering the prescription drugs market; shares of CVS and Walgreens dropped by 4% and 5% respectively, while Express Scripts is now trading at its lowest point since 2013.

Even Swatch shares flattened when negotiations between the watchmaker and Amazon stalled. As Prof. Scott Galloway observes, we may be on the precipice of a Singularity but not the good kind. . . The Amazon Singularity!!!

Prof. Galloway said that one of the key components of the free market is that no one individual or firm controls the market. However, concerning the consumer market or specifically the market capitalisation of consumer companies, it's not interest rates, consumer trends, not even the underlying performance of the company that matters. The one factor driving shareholder declines right now is whether or not Amazon is planning to come into your category or distributor your products.