Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week Visa reported their 4Q and full year numbers, beating market expectations on the top and bottom line. Reading through their earnings call, it is amazing to see the insights that they get globally, thanks to seeing spending changes. They have noticed a spending drop off in areas hit by recent natural disasters. More developed regions spending returned to normal in a shorter period when compared to less developed areas. Another thing they pick up is the impact of currency changes on spending and travelling. Speaking of travelling, they saw a 10% rise in the number of cross-border transactions; high margin business for them and good news for our investment in Priceline.

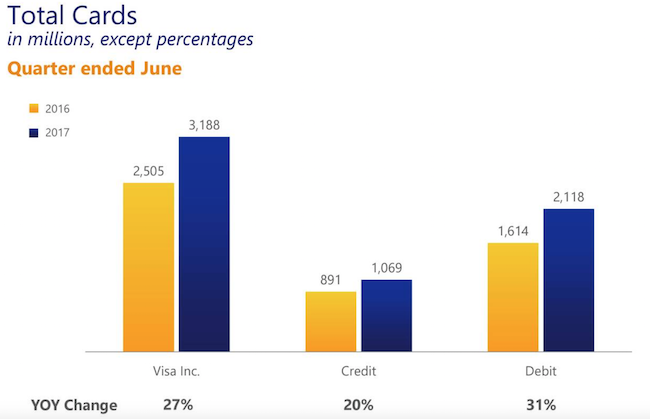

Arguably the most important number, indicating future business potential is the number of cards in issue. The number is huge! With around 3.2 billion cards, that is almost enough cards for one in every two people on the globe to have one. I had a look in my wallet, there are 3 Visa cards in there, which I guess is the average for most people?

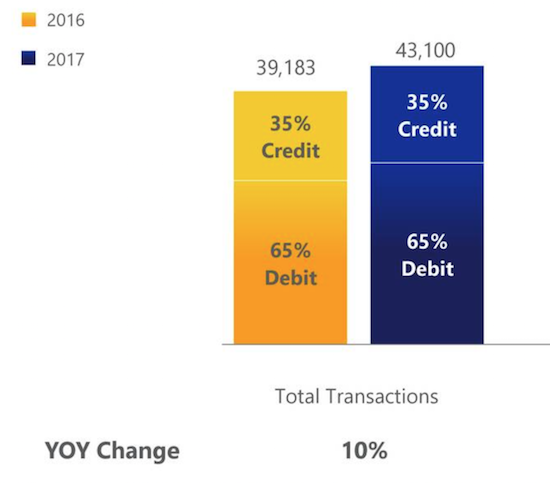

Onto the numbers. Revenue for the full year came in at $18.4 billion, an increase of 22%. Net income clocked $6.7 billion also an increase of 22%. The growth was driven by the purchase of Visa Europe last year, which is performing better than expected, both in terms of revenues and in terms of lower costs. As more people become comfortable with not using physical cash, the number of swipes go up. For Visa, they processed 43 billion transactions in only three months.

Management is ploughing money into share buybacks; using cheap debt to buy back shares. Depending on the direction of the share price, this can be a great idea. If you are an Anglo American shareholder, you would rather forget all the buybacks done at R450 a share, back in 2008. As a Visa shareholder, the strategy is working well. Over the last financial year, Visa spent $6.9 billion on share buybacks, at an average purchase price of $90.31, translating into a 22% return for shareholders. For the current year, management plans to spend $9 billion on buybacks and dividends, around 3.5% of Visa's current market cap.

One of the questions we get asked regularly is if Visa will be around in the future due to cryptocurrencies. As it stands at the moment, using Visa is cheaper, quicker, safer, easier and uses less electricity than purchasing with the likes of Bitcoin. Going forward, I think we will operate in an environment where cryptocurrencies play a role but the network Visa has built will still be the dominant player for payments. Happy to continue holding this company for decades to come.