Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week we had second quarter results from high flying Nvidia. As is often the case with stocks that have done incredibly well over a short period of time, expectations were high. The results also coincided with a sizeable tech sell off last week. The share price is off over ten percent since the results were released, trading at the same levels they were at 1 month ago. That should give you some perspective.

Revenues were up 56% from last year to $2.23bn. Earnings per share were up a whopping 91% to $1.01 for the quarter. Expectations are for the company to make $3.71 next year and $5.47 in 2019. That is a possible 48% growth in earnings off what is already a fast increasing base. At 42 times next years earnings, the market has high expectations but you can see why.

A quick refresher, Nvidia manufactures Graphic Processing Units (GPUs). These are specialised electronic circuits used for image processing on a display device. They are more efficient than CPUs at processing more complex algorithms due to being able to do multiple processes at the same came. Nvidia actually termed the phrase GPU after creating the first of it's kind in 1999 used for gaming.

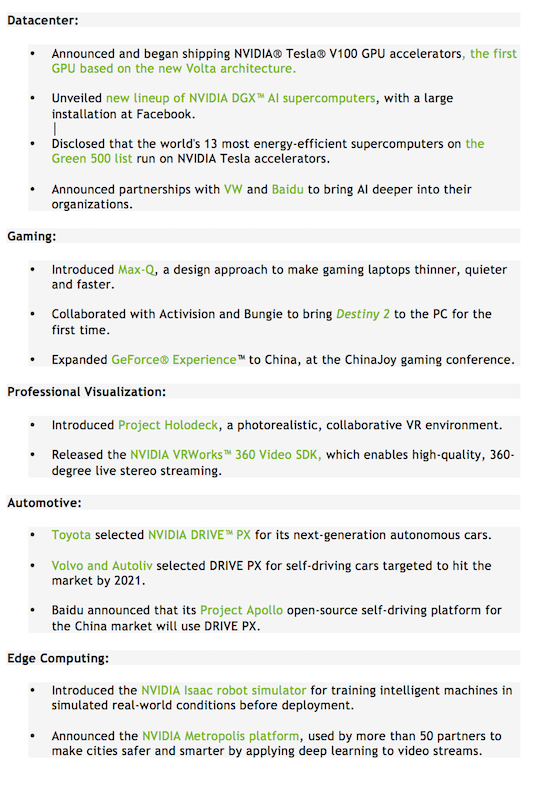

The demand for GPUs has exploded into all sorts of industries. In the Nvidia results they breakdown demand into 5 sectors. The image below lists these 5 sectors as well as recent developments within those sectors. You will notice collaborations with many well known business giants.

The biggest division is still gaming which contributes about 53% of revenues. Datacenter is the next biggest, contributing 19%. Pro visualisation contributes 10% and automotive contributes 6.4%. It is unclear which division mining cryptocurrencies falls within but Goldman Sachs estimate that these revenues exploded in the quarter and represent nearly 10%.

Cryptocurrencies, self driving cars, Internet of Things (IOT), robots, cloud storage, gaming, video, website hosting, Artificial Intelligence (AI) and Virtual Reality (VR). Nvidia chips are key to the success of all these exciting industries. Although the stock is expensive, we feel that the company will continue to grow like gangbusters. The ride will be bumpy, this is buy rated for clients with tolerance for volatility.