Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Visa inc. reported their third quarter results for the period to end 30 June. It was a beat by most metrics, the business reported net income of 2.1 billion Dollars, or 86 US cents per share off revenues of 4.6 billion Dollars. Remember that Visa Europe is now fully integrated into group, payments volumes increased a whopping 38 percent to 1.9 trillion Dollars. 28.5 billion transactions in total. During the quarter, the group also returned 2.1 billion Dollars to their shareholders, by way of dividends and share buybacks (59.2 million shares bought back at an average of 86.82 for the last nine months). There is still 5.5 billion Dollars available for repurchases inside of the current program, or roughly two and a half percent of the current market capitalisation.

This is a pretty incredible business. Their model is simple, yet the technology is always evolving too. Every electronic payment needs to be processed, to make sure that the relationship between the cardholder, the issuing bank, the merchant and the acquiring bank (of the merchant) is honoured, all seamlessly. It seems pretty easy, at the end of the day it all boils down to trust. The cardholder and the merchant have to trust that Visa will be able to switch their transaction. And that is for all points, everywhere in the world. The network is capable of handling 65 thousand transaction messages a second. Quite simply, they make your life a whole lot easier, whether you are using your debit or credit card to complete the transaction, either at the physical location (the merchant) or online.

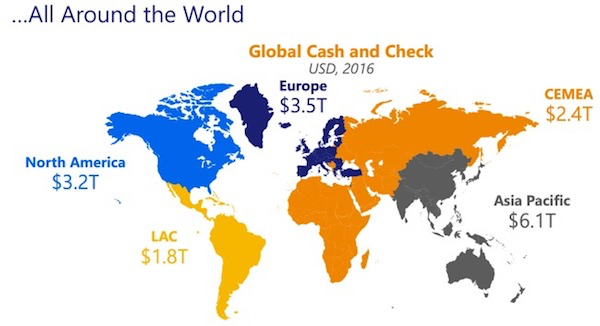

The stock always trades on a pretty lofty multiple, that is as a result of continually growing their revenues and earnings at a fearsome click, the company expects revenues to grow by 20 percent for the full year. Earnings per share are expected to be around 3.40 to 3.50 Dollars a share. At the record close on Friday evening (99.60 Dollars), the stock trades on 28 times expected 2017 earnings. Not cheap by any measure, a growth business with lofty expectations. I suspect that they will continue to meet and surpass expectations, there is likely to be less and less cash in circulation, businesses like Visa will take care of the elimination of physical notes and coins. There is still around 17 trillion Dollars in cash and checks that will in time convert to electronic payments. See the image below to reflect that this is a global phenomenon.

I suspect that the company has a very bright future. Governments want trails for transactions. Businesses and consumers want easier payment methods that eliminate physical cards (think of all the cell phone payment methods). The shift to digital (online) from physical (at the store) benefits Visa above their competitors, as a result of having built the wider net from a technology point of view. With the current share price of close to 100 Dollars, there may be little wriggle room for the next half a year or so, this really is a business that you can stick in your back pocket and hold on a "forever" basis.