Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

"Visa has recognised the net benefits for merchants when they reduce dependency on cash transaction. Visa recently conducted a study that found that if businesses in 100 cities transitioned from cash to digital, their cities stand to experience net benefits of $312 billion per year. According to this study, in New York City alone, businesses could generate an additional $6.8 billion in revenue and save more than 186 million hours in labor, by making greater use of digital payments. This amounts to more than $5 billion annual costs savings for businesses in New York."

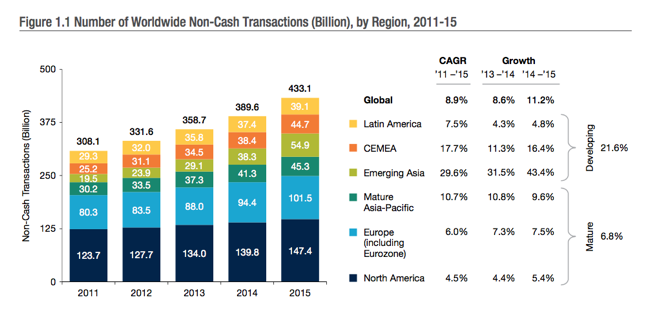

At the same time, a report titled World Payments Report 2017 appeared two days ago. There were some interesting graphs in there, mostly around the use of payment methods via cards, and electronic payments. There are going to quite simply, be more and more of these. First things first, with the "latest" data from 2015, herewith the Number of Worldwide Non-Cash Transactions (Billion), courtesy of Capgemini (they are actually reporting results today) and BNP Paribas.

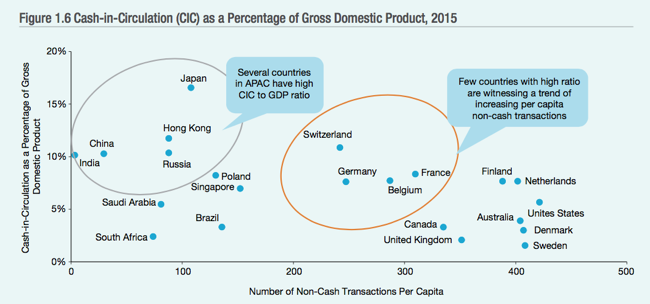

For me, a more challenging graph and a sign of great things to come (with India and China on a very low base), is the following graph. The X axis represents the number of non-cash (i.e. electronic) transactions per capita for the country. Understandably Sweden, Denmark and even the US is very high. At the opposite end of that list is India and China, both with huge populations and low electronic payments. The Y axis represents the amount of cash in the country relative to the GDP of a country.

What is interesting is that Japan has the highest cash in circulation relative to their GDP, higher than India, ourselves and Brazil. Perhaps that has to do with an older generation being used to the idea of cash. The average age in Japan is around 47, as you can imagine, if you were born in 1970, you are less receptive to Apple Pay, PayPal and Visa cards. South Africa, for example is 27 years, most young people are receptive to the idea of change. Older people .... not so much.

Anyhows, all of this shows one thing. Electronic payments are going to continue to grow. Governments, banks, even consumers are changing their mindsets to carrying cash. Bank notes may well become a relic at some point in the future, which is why we can remain long Visa for a long time. Which we plan to.