Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

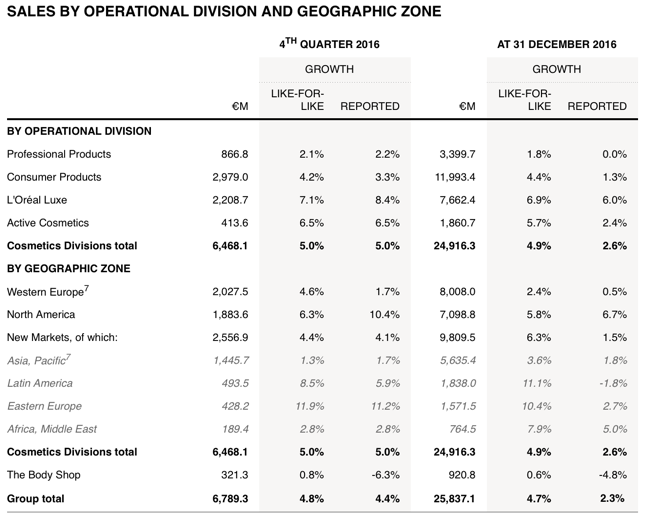

L'Oreal reported numbers for their full year last evening, after the market had closed in Paris. The company continues to attract market share across all territories, sales grew 4.7 percent like for like to 25.84 billion Euros, earnings per share increased by 4.6 percent to 6.46 Euros per share. For the purposes of this exercise, when talking about valuations, we will reference the Paris price, which is 174 Euros a share. The stock trades at a pretty lofty 26x earnings, which is not cheap at all, the company has delivered in what has been a pretty tough operating environment. The company has four major operating divisions, you can see the breakdown via a previous message on the business - L'Oreal 3Q numbers - steady growth. The dividend has been jacked up by 6.45 percent to 3.30 Euros, maintaining the nearly just under 2 times dividend cover.

In terms of profits geographically, Western Europe is their strongest market in terms of profits relative to sales. The company always has the most fabulous revenue by geography and revenues by segments. All the divisions are of a similar operating profit as a percentage relative to sales, around 20 percent. It is a key metric of theirs. The company spends a large slice of sales on telling you how amazing the products are, I guess that it is a very competitive market.

The company is looking to sell the Body Shop, this is not new news. They are looking to fetch around 1 billion Dollars, it is going to be hard to find a buyer for that business, as a recent Bloomberg Gadfly article pointed out, it is neither hipster nor is it new, and it is definitely not premium - Making The Body Shop Great Again.

The investment thesis is pretty simple, the company is the leader (around 28-29 percent cosmetics) in a growing market globally, around 3.5 percent. The cosmetics market is growing at a faster click than global growth, there are many more woman enjoying soft luxury than at any other time in history. The company continues to expand their presence across all the social media platforms, they have multiple platforms across Instagram and Facebook, as well as Twitter. Simple things, such as tutorials for applying makeup, new products and product range. The company now has around 1000 people working on these platforms, they certainly take it really seriously, it is a great feedback loop.

This is a deeply loyal product for many people, once you trust and apply the product, or use the shampoo and associated hair care, you are likely to stick with it for years and years. The share price performance has been pretty pedestrian, keeping pace with a weakening Euro to the US Dollar. We hold the unsponsored ADR. To illustrate the point, the share price performance in Euros over five years has increased 114 percent, whilst the Dollar based price is up "only" 73.9 percent. I will take that Dollar return any day of the week. A currency unwind, should we say, would be helpful for our Dollar investments in a European currency denominated company.

This is a great defensive and growth business, their products are always going to be used. The company will continue to grow as global GDP rates grow, and remains a key pick in our consumer based investment theme. We continue to accumulate.