Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

L'Oreal is a really great business, one of my favourite models. The Dollar share price might not have done that well, i.e. this is a case where the company has delivered and there have been certain currency issues that have weighed (and shareholder issues too), we think that the long term thesis remains intact. The group is certainly very focused on developed markets, namely Europe (around 1/3 of sales) and North America (just over one-quarter) and then the various other emerging markets, Asia Pacific accounting for 22.5 percent of sales.

In terms of their various product mix, it is skincare at nearly 30 percent, make-up at nearly one-quarter of all sales and then haircare (shampoo and conditioner) at nearly 20 percent that makes the bulk of the sales. Hair colouring (I could use some, looking a little grey at the edges) accounts for around one-eighth of all sales. E-commerce is a growing segment, yet only accounts for a little over five percent of all sales. In China that number jumps to 20 percent plus of total sales. I suppose it is simple, once you know what works, you can easily buy that time after time.

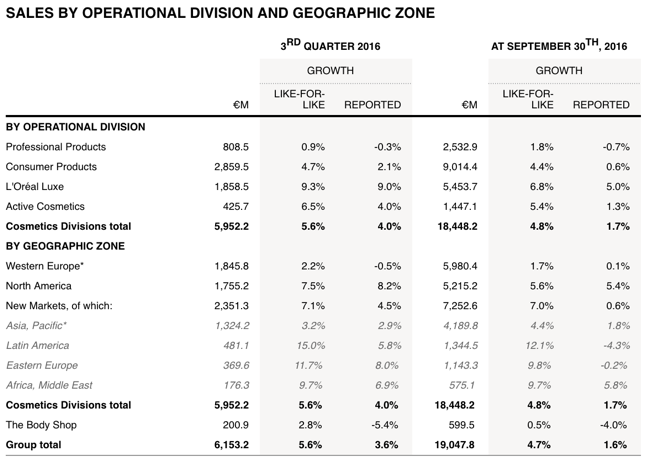

The company released their 9 month sales update a couple of weeks back, "things" have been a little busy and we did not get a chance to get them yet. Here it is - > Sales at September 30th, 2016. For the quarter it was the L'Oreal Luxe division that did well. Reminder, in case you needed one, here is a great breakdown of all of the brands from the last annual report, separating all of their brands by business segment:

More recently, in the last three months, L'Oreal have acquired IT Cosmetics (make-up) and Atelier Cologne (perfumery), both relatively new and niche businesses added to the 32 brands. Herewith a breakdown of the sales:

Negative headwinds from the Brazilian Real, the Russian Ruble and the British Pound were felt during the quarter. There are persistent negative sales patterns in France. What I find most interesting is that the uber luxury brands, the "Luxe" division grew in the US strongly (market share gains) and a good performance in China, a dynamic luxury goods market in that part of the world also gaining market share. Also Eastern Europe. Surprising here that the core brands are underperforming the luxury.

All in all, we like this business long term. More aspirational consumers around the world reaching for the better quality products. The global markets are split as follows (according to their research, quoted in the annual report), 36 percent skincare, 23 percent haircare, 17 percent makeup, 12 percent fragrances and the balance hygiene products (10 percent) and others. Geographically, sales are dominated by Asia Pacific (36 percent) and North America (24 percent), whilst Europe clocks in at just above 20 percent. Latin America is 10 percent and Eastern Europe is 6 percent. You can quite quickly see that L'Oreal has plenty of room to grow in Asia Pacific and more specifically China, where their luxury brands are gaining huge traction.

Important trends include indie brands (hence the recent acquisitions), organic and sustainability (something that L'Oreal are working hard on currently), active cosmetics (combining healthcare and make-up) and even pro-aging products. The whole idea that you can show your current age and still use cosmetics. The more ideal concepts of beauty, making sure that the products still do their job, yet make you feel comfortable at your specific age. Anyone out there want to elaborate more please?

As we said, the share price has been a downright disappointment for investors, at least in the very short term. L'Oreal are a whole lot less leveraged than their peers and trade at a pretty big discount relative to their historical multiple. The business also has an element of defensiveness too, hair washing and make up application (and removal) and general facial care is hardly going to go out of fashion. As we explained in our view at the half year stage - L'Oreal 2Q & 6 month number - still very profitable, cosmetics and urbanisation go hand in hand. I also think that we are scratching the surface in terms of mens cosmetics. Maybe not the generation of my dad, perhaps not even mine, definitely the one thereafter. It is early stages.

Defensive and growth, this is a good business, the big daddy of the industry. We continue to recommend this stock, we continue to accumulate. Buy.