Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

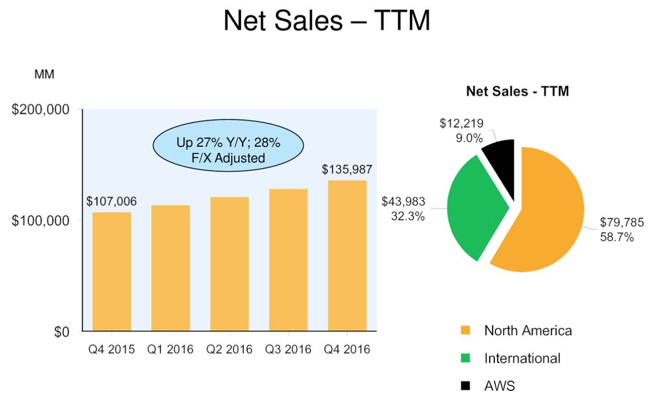

Amazon reported numbers after hours, this was for the "holiday" quarter - Fourth Quarter Sales up 22% to $43.7 Billion. The sales number fell short of expectations and guidance, as much as 1 billion Dollars or around 2 and a bit percent relative to what the market expected. The company reported profits ahead of consensus, that matters little when you are owning the stock for the sales growth. There is a major contributor over the last few years, that being AWS (Amazon Web ServiceS). In case you needed a refresher - Amazon AWS update.

Whilst AWS is a smaller contributor to total revenues, 12.2 billion Dollars relative to total group sales of nearly 136 billion Dollars, it is more reliable from a profitability point of view, representing 3.1 billion Dollars of the total of just shy of 4.2 billion Dollars of operating income for the group. AWS is growing at nearly 50 percent per annum, more and more businesses are moving their solutions to the cloud. The whole idea that you don't have to own the hardware is very appealing. AWS managed to migrate 18 thousand databases across to their hosting zones during the year. That is nearly 50 databases moving each and every day. Here you can see the breakdown of the businesses relative to one another:

Amazon North America is a profitable business, much more of the infrastructure has been rolled out, relative to the "international" part of the business, in the core "older" Amazon business. The introduction of the "prime" offering will continue to weigh, as the company continues to leak (at 99 Dollars per person, it is neither cheap nor expensive) in the startup costs, China is the newest "prime" membership area.

There were and always are many highlights for this company that innovates constantly. Amazon Air Prime is being piloted in the UK, a drone delivery service, their movies division (Amazon Studios) was nominated heavily (11 nominations at the Golden Globes, seven Academy Award nominations), and won best actor in a movie and best actor in a TV series drama at the recent Golden Globes. Alexa enabled devices (the Echo and others) were the top seller during the past quarter across all categories. As the company points out, they (and it is very cool that they keep track) launched 1017 significant services and features in 2016. That is basically 20 new services and features a week. Innovation will always be at the forefront of this business.

Guidance for the current quarter was not what the market was expecting either, and the stock sank heavily. Down over four percent pre market, near the 800 Dollar mark. We think that this represents a fabulous opportunity. We are expecting this business, on these revenue growth rates to top 200 billion in sales by the end of the next year, and whilst the multiple looks outlandish, know that the company is investing heavily in the future, building a retail convenience (and cloud business) giant second to none. We remain buyers of what is a wonderful opportunity.