Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

JnJ reported their full year and 4Q numbers on Tuesday before the US market opened. Off the bat the market wasn't impressed with the forecasted numbers for the coming year, with the stock dropping 2%. The drop highlights how stock prices are current expectations of future profits.

Onto the numbers, sales grew by 2.6% to $71.9 billion for the FY, most of the growth came from the US where sales grew by 6%. On the international side, sales dropped by 0.9% mostly due to a stronger dollar. Earnings grew 7.6% to $18.8 billion for the FY. Thanks to less shares in issue EPS was up 8.5%. So not a small company by any measure. The reason for small top line growth but stronger bottom line growth is due to cost cutting on the "selling, marketing and administrative costs" segment.

The main thing that I think is attractive about the company is that it is 3 businesses in one company. Their main business is their Pharma division which had sales of $33.5 billion, growth of 7.4% and profits of $13.1 billion. Next in line is their Medical Devices business which had sales of 25.1 billion, small growth of 0.9% and $8.1 billion in profits. Then lastly is their consumer division which had sales of $13.3 billion, growth of 1.5% and profits of $2.6 billion. The strongest growing segment of the consumer division was Beauty which grew at 9.4%.

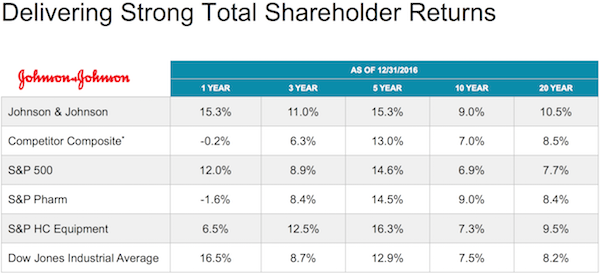

JnJ is one of those companies that ticks all the boxes. It covers healthcare, it covers new technology, it covers consumer products and it is an international player. Given its huge size the growth rates are never going to be eye watering but its size brings diversity and stability. Courtesy of the company here is how shareholders have done over the years. Still a buy in our books.