Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Naspers delivered results on Friday afternoon. First thing to remember is that back in April the company changed their reporting currency to Dollars, for the purposes of standardising across multiple geographies. As they point out in these results, revenues derived outside of the borders of our country represent 80 percent of total revenues, so it makes sense to report in US Dollars and not Rands anymore. This is a sign of the business continuing to mature and attract more customers across the globe, as we often say, you cannot carry your hopes on only 50 odd million customers, you need to attract all of them, all across the globe! As the release points out, costs for their ecommerce business are incurred in the local currency, as such the currency movements are "diffused", whereas in the video entertainment segment (TV and streaming) you earn local currencies, your costs are in Dollars. i.e. your subscribers are buying content in local currencies, you are paying Dollars for said content.

There are lots of moving parts in these numbers, as there always are with Naspers. In order to keep abreast with an ever changing world, the company has to be constantly on the lookout for the next big trend in consumer entertainment, that is what they are, an entertainment and internet services business. When one says internet business, immediately the normal reaction is one of confusion amongst investors. Yet many of Naspers' websites are simply service related tools in order to buy used goods, classifieds in order to get that product or simply to book that trip or obtain pricing comparisons. All they are, their various global websites, are enablers of the same thing we know (payments portals) for the same thing. They just take place on the internet, which is another method of doing the same things. I think that some people just miss this.

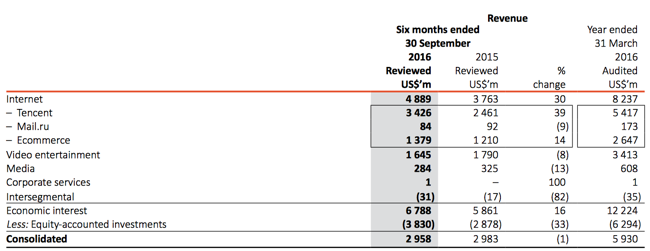

As the group states on their website: "We believe in the power of local backed by global scale and we look for opportunities to address big societal needs in markets where we see the greatest growth potential." Sounds pretty simple, right? OK, moving swiftly along ...... Herewith the interim results release to September 2016. On a segmented basis, herewith a table from the results:

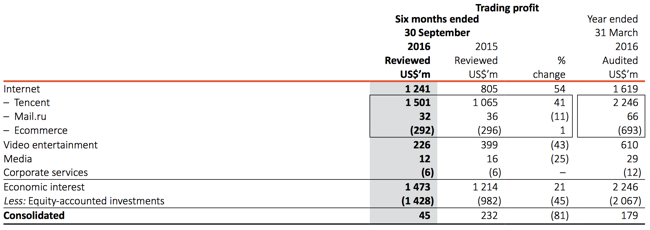

And then of course, you can have all the revenues in the world, you need to be profitable, herewith trading profits from the group:

It is fair then to say that the group is undergoing another metamorphosis. Entertainment and video (i.e. streaming) is taking up some serious monies, high spend in order to get the content that the customer needs and wants. The evolution of TV is going to be huge, and is ongoing.

So what do you get when you buy and own this business? You get insightful management who are in tune with global entertainment and global ecommerce trends. They will sell and buy assets that they perceive to be in segments that either are ex-growth or pre-growth. Ecommerce looks like a great business, operating in many non-english speaking countries as the dominant player. Interesting that the group points out that Flipkart in India is experiencing strong competition from Amazon, that is to be expected. That fellow Bezos says that he sees India as a huge opportunity. I suspect that all of the majors in India, provided that they have a fairly dominant market position, will do well. Flipkart and Amazon will both be "ok".

The prospects outlook is as follows: "In the second half of the financial year we hope to deliver revenue growth and scale to the more established ecommerce businesses. The group will continue to invest in long-term opportunities such as letgo, and seek further promising models within the internet segment. We expect to accelerate letgo's development spend to further strengthen its position in the US classifieds market. In African video entertainment, a tough environment at present, we aim to grow DTH customers by offering increased value and reducing costs to counter the impact of falling currencies. Earnings and cash flows in this segment will continue to be constrained in the foreseeable future."

In short, expect more of the same. Do not expect huge dividends from excessive cashflows. Expect the group to invest heavily in what they perceive the future to be. Expect them to sell some businesses that you may well like as an investment, expect them to buy businesses that have good growth prospects and look at face value as unprofitable (for now). Expect volatility. That said, we continue to recommend the company, and we expect the continued strong growth in revenues to translate to higher profitability. The sum of the parts valuation is important here. In our view, Naspers is undervalued and should be bought on weakness, that currently exists.