Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

JNJ reported numbers for their third quarter yesterday, before the market opened. Before we get into those, let us have a look at the business. They operate across the globe, although in 2015, 51 percent of their sales were from the US, 23 percent of sales come from Europe and 18 percent from Asia Pacific and our continent. The balance (8 percent) is classified as "Western Hemisphere", which means Central and South America, as well as the other countries in North America. In terms of divisions, JNJ sales are (or were last year) split as follows: 45 percent pharma, 36 percent medical devices and 19 percent consumer. The company spent just over 9 billion Dollars last year on research and development (12.9 percent of sales), many of these businesses spend around 10-14 percent of annual revenues on searching for the next blockbuster, that will save countless lives in the future.

What is quite remarkable about this business is that the bookkeeping entires go all the way back to the founding of the business (three brothers, not two), the first time the company clocked 100 million Dollars of sales was just after the second world war in 1946. They clocked 1 billion Dollars for the first time in 1970. And 1 billion Dollars in profits for the first time in 1989. In 2005 the company registered sales of 50 billion Dollars and profits of above 10 billion Dollars. In 1946, on a stock split adjusted basis, the share price was around 2 cents. The stock traded on a multiple of 7. By 1970, the average share price was 1.06 Dollars per share. And the stock traded on a 43 multiple! What?? Through ten Dollars for the first time in 1991, 100 Dollars a share for the first time in 2014. Since 2005 the stock has traded in the mid to high teens in terms of valuations. Since 2005 the company has added 20 billion Dollars in annual sales to the 50 billion back then.

It is always fun to check back. And to wonder why your grandfather just didn't buy 10 shares in 1972. The investment calculator on the JNJ website says that if one had bought (and reinvested dividends), the original cost was 981.30 Dollars and the current value would be 91,735.43 Dollars. And as a result of reinvesting and all the dividends, you would have 774 shares now. For the record, 981.30 Dollars from 1972 is equivalent to 5615.51 Dollars today. The benefits of long term stock ownership in big, well capitalised and quality businesses are plain for all to see. Of course history means nothing in investing when trying to predicting future returns. The exercise is a good one. Shortening the time frame to 25 years, the returns (including reinvesting the dividend) are 16 fold.

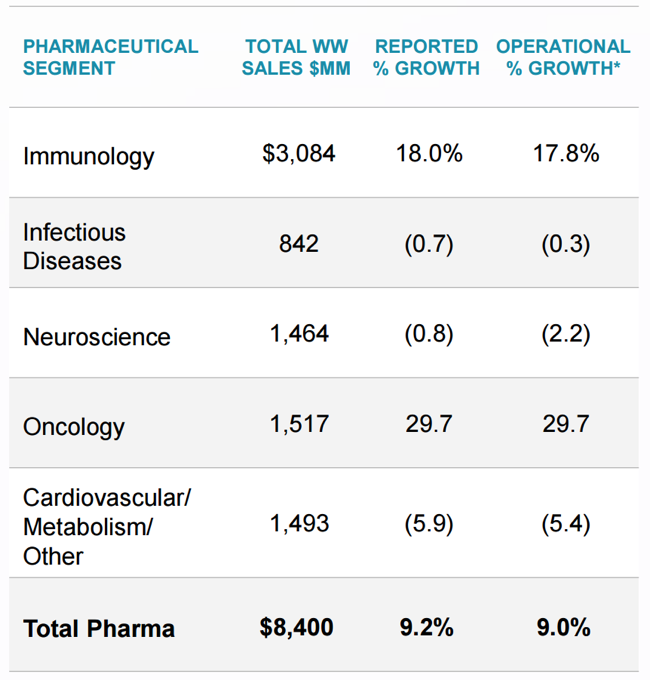

Let us check the results from yesterday morning, Q3 2016 Earnings. Sales were 4.2 percent better than the comparable period, adjusted diluted earnings per share clocked 1.68 Dollars, an increase of 12.8 percent from the prior period. I think that in order to show the diversity of this business, three separate businesses inside of a business, let us check the different segments. Firstly, their biggest division, pharma:

Immunology includes Remicade, which does 1.2 billion Dollars in sales just by itself. Some anxiety has emerged in recent days as Pfizer may well release in November a biosimilar (copycat biopharma drug) called Inflectra. JNJ are actually fighting this in court, watch it closely. And it is easy to see why, according to the WSJ, the analyst community has suggested that the Pfizer drug, which is 15 percent cheaper, could shave off 1 billion in annual sales for JNJ. A year of therapy of Remicade in the US costs nearly 29 thousand Dollars, before any of the medical insurance refunds. Phew. Remicade treats Crohn's disease, Ulcerative Colitis, Rheumatoid Arthritis, Ankylosing Spondylitis, Psoriatic Arthritis and Plaque Psoriasis. Yip, it is pretty wide reaching. Amgen have a very similar drug that is used to treat most of these conditions, it is called Enbrel.

A therapy called Imbruvica, which is a blood cancer drug is expected to be one of the drivers of future growth. Another drug, Xarelto competes with Aspen in the blood thinning area, the drug does similar things, preventing clotting, prevents deep vein thrombosis and pulmonary embolism. The company is confident that their pipeline which consists of around 10 therapies that could each be 1 billion Dollar of sales a year. As well as new uses for around 10 of their current therapies too. If you want to see what is in the pipeline, follow the link.

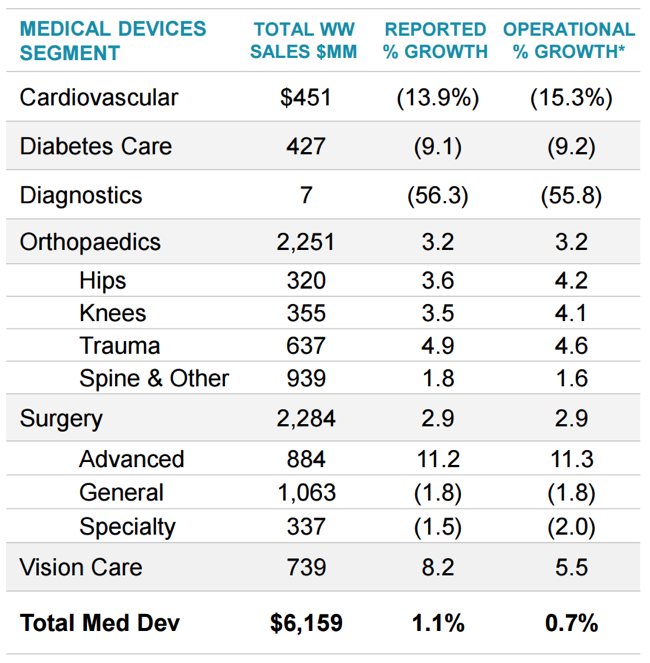

Next, the medical devices division, which is a monster standalone business by itself. Here is a breakdown of the sales

Orthopaedics is expected to be a good growth business in our opinion, it is a simple investment in people living longer and having access to high quality parts to give them a higher quality of life. General Surgery too should continue to be a global growth business, as people get richer, they are more likely to have more surgeries.

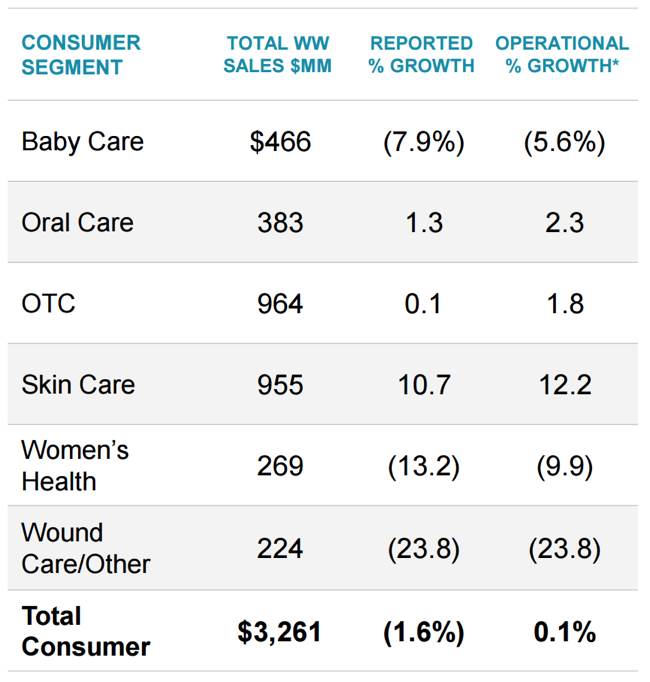

Next and last, the well known consumer business, a lot of household brands that Joe Consumer is very familiar with.

I found it quite interesting that the company reported strong sales in their anti-smoking aids in Asia Pacific and the Middle East (and Africa), that is a product you may know as Nicorette. The CFO suggested that they were a bit light in the skin care division, there may well be some purchases in that area. Acquisitions of that sort would bolster the consumer division, many short term agitators have called for a break up of the group. Separate businesses will perform better and attract a higher multiple, they say. Be more nimble they say. That may well be the case, one of the reasons that makes JNJ such a compelling investment is precisely the diversity.

The stock fell away during the course of trade, down 2.6 percent on an up day. There is anxiety over loss of sales of Remicade, one of their flagship products. The company has actually guided higher in revenues and earnings though. The stock trades on a 17.2 multiple, hardly expensive for a quality business. Whilst the stock and the company may not display the explosive growth prospects of some of their peers, this is definitely a "safe as houses" investment. In fact, I would go further and say that it is safer than houses, you can buy JNJ for your unborn great grandchildren. They will thank you. We continue to buy for new clients and accumulate for those who are underweight.