Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

At the beginning of the last financial year, 1 April 2015, the website synonymous with online booking, Booking.com (parent company and listed entity Priceline.com), had 670,000 places to visit. On August the 5th, 16 months later, the company announced that they had Added Its One-Millionth Property in Nantucket, Massachusetts. Of those, as you can see from the release, there are 23 million bookable rooms around the globe, with 7.2 million of those being homes, apartments and villas. Half of the total properties are NOT hotels, which in a sense allays many peoples fears that Airbnb will eat their lunch. They are all eating the same lunch. Besides, the biggest listed competitor in its space is Expedia, which is only 11.6 percent the size of Priceline.com.

Priceline has a market cap of 73 billion Dollars as of the last close, that is monumental in itself. And yet, the stock is neither cheap, nor is it expensive. At 27 times historical earnings and with the analyst community predicting over 68 and a half Dollars of earnings, the stock trades forward on just over 20 times. Growing earnings and revenues at a pretty breakneck speed, the same said analysts have the company making nearly 80 Dollars a share next year, and the multiple unwinds to just above 17 times earnings. Currently the company pays no dividends to their stock holders, growth is the current focus.

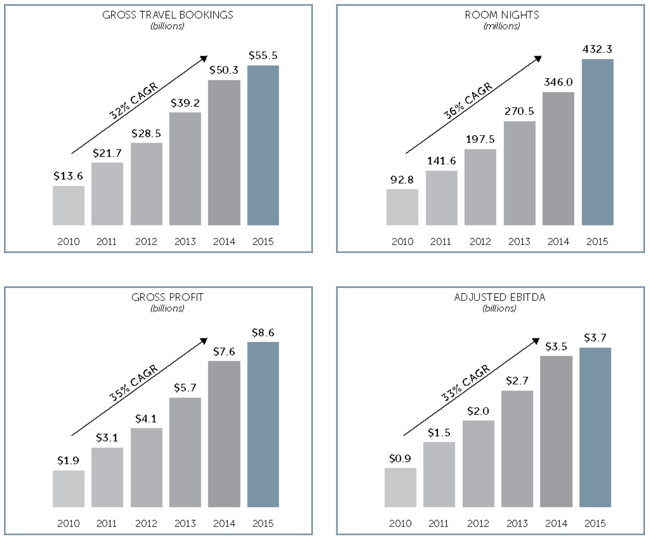

Herewith from the annual report from last year, these are all the key metrics which shows the meteoric rise in bookings and profits over the last 5 years.

So how does Priceline.com earn their money? The annual report breaks it into a few categories, processing fees (on behalf of smaller places of accommodation), commissions earned on the facilitating of accommodations, hires of rentals, ship cruises, as well as advertising revenues earned by KAYAK, one of their multiple platforms. They also recently, having acquired OpenTable, earn reservation revenues. And what do they plan to do, in order to continue to grow their revenues? Providing a great booking experience (they may want to work on that, it is easy, it could be easier), they are going to continue to partner with other travel providers, as well as restaurants (get the complete package), as well as investing heavily in other platforms. For instance, as they point out, they invested in Ctrip, a Chinese mainland operator. CTrip is actually listed in New York, and has a market capitalisation of nearly 20 billion Dollars.

Google and Facebook may well roll out large booking systems. I was quite interested when reading about online booking behaviours. It is different for business travel over personal. In business travel, over half of people in North America book their own business trips - Business traveller booking behaviours.

Tripadvisor (a competitor of sorts) had their 6 key travel trends for 2016, in which Trend#6 was quite important for me: "93% of hoteliers said that online traveler reviews are important for the future of their business" and "Online reputation management is still the biggest area of investment for accommodation owners in 2016, with 59% investing more in this area than they did the previous year."

Which means that more and more travellers will trust websites like Booking.com more than any other platform. The fact that the property is rated 9 out of ten and you can see the comments (petty or not) and the interaction with the management, means that all the dirty laundry is laid out bare. For all to see. The consistently higher you score, the more money you make, the more you are likely to promote your property on the website. All the reviews are for actual guests staying there, you only get a review request if you book through the platform, or are invited by the establishment.

So here goes, the last set of numbers: The Priceline Group Reports Financial Results for 2nd Quarter 2016. Revenues grew by 19 percent to 17.9 billion Dollars, gross profits increased 16 percent to 2.4 billion Dollars. That is nothing though, this is the dominant online business, and global revenues for the travel bookings industry is at 1.3 trillion Dollars. Their, Priceline.com, share is less than five percent. As such, there is plenty of road to run here. We continue to accumulate a growth business at a very reasonable multiple, relative to their growth prospects.