Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Alphabet reported numbers last evening, this is for the second quarter to June 2016. The half year too, something that we are a little more accustomed to around these parts. Revenues for the quarter grew 21 percent over the comparable quarter in 2015, and 6 percent better than the previous quarter. Yowsers, that is some pretty exceptional growth. In constant currencies, as we still live in a world of relative Dollar strength to everything else, revenues increased 25 percent relative to the quarter this time last year. For comparisons sake to Facebook, who reported yesterday, Alphabet clocked revenues of 21.5 billion Dollars, more than three times that of Facebook.

Non-GAAP income bolted on another billion Dollars versus the prior quarter, clocking 5.864 billion US Dollars. On a per share basis that equals 8.42 Dollars. Reminder, the stock price is at 797 Dollars pre market (up half a percent in normal trade and another 4.1 percent after hours), the analyst community currently estimates that somewhere in the region of 33 and a half Dollars worth of earnings for the full year next year, and nearly 40 Dollars a share the year thereafter. Anyone can do that math, the stock trades on just less than 20 times earnings to the end of 2018. Got it? As we all know well, the company does not pay dividends yet, having embarked on a weird share buyback program for the first time, a very recent event.

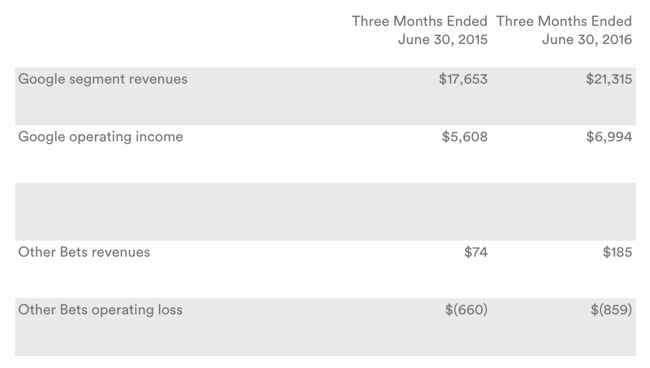

The company may as well be called Google, if you see this table below you can see that the segment "other bets" generates paltry revenues of 185 million Dollars, relative to Google which generate 21.315 billion Dollars. And of course, with many of the "other bets" being in startup and ramp mode, they are going to suck a lot of cash, and obviously make a loss. It goes without saying. Ruth Porat (the CFO) said on the conference call that many of these "efforts" are pre-revenue. i.e. in development phase. Mostly Nest (the camera and home automation business), Fiber (you want more of that, right?) and Verily (healthcare and technology).

Cash on hand, at the end of the quarter swelled to 78.4 billion Dollars, again, a little over three times the cash that Facebook currently has. Added to the swelling cash balance is a swelling staff compliment, up to 66,575 Googlers. Err .... Alphabetters? The cost per click reduction rate seems to be levelling off, the rate of decline that is. This can be measured against ARPUs, where trends differ from geography to geography, emerging markets still finding their meeting, developed markets are possibly almost all data. Who calls anymore, right? Most of the new hires, according to Ruth Porat, the CFO, are engineers and product managers, to support (and I am almost copying and pasting from the earnings call) growth in priority areas like cloud and apps. Percentage wise much more at "other bets", numbers wise, still dominated by Google.

Talking of calls, the most juicy information that I find is almost always inside of the earnings call. The after the market get together when the analysts and the management get to present a few smart looking questions to impress their peers (in the case of equity analysts) and the answers from management to stick them on the straight and narrow. Everyone asking the questions and invited to participate wants to be Benjamin Graham. Here goes, sign up (for free) to read Alphabet (GOOG) Q2 2016 Results - Earnings Call Transcript.

So what does one learn here? YouTube (without giving an absolute number) revenues continue to grow "at a very significant rate". Strong growth in mobile search, use your own smartphone experiences to confirm that, it is clear that this is a strong growth engine right now. I couldn't quite figure this out, it seems that YouTube has been acquiring original content at a quicker click. Machine learnings and Artificial Intelligence spending will position the business well for the future said Google (the core business) CEO Sundar Pichai. That will build the engine to drive the future, he said. I really liked this line, I believe it with all my heart (dangerous when analysing businesses, I know), from Pichai: " ... building for everyone; since the Internet is one of the world's most powerful equalizers, we are committed to building technology and making information available for everyone, wherever they are." The ability to learn anything, no matter where you are in the world is an important step for humanity.

In conclusion, this is a company that really has a huge growth business as their core business and many more lines in the water. This is definitely a huge growth business. They are creating future revenue streams that we couldn't envisage now, encouraging staffers to be creative (certainly rewarding them for it) and making life easier each and every day. The company shares today the same vision that the founders created early on. We continue to buy, with a great deal of conviction, what is an incredible company with an amazing future. Own more, buy some for the first time. The stock traded as high as 810 Dollars a share (near an all time high) in the aftermarket, post the results release.