Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Amazon reported numbers after-hours yesterday. This is an incredible business too. The founder has pretty much tried everything, you may recall the infographic from the Visual Capitalist - How Jeff Bezos Built his Amazon Empire. There are tons of things that the fellow has started and failed at, it is better to have tried and failed rather than to have never tried at all, as they say in the classics. Straight into the new age retailer's results - Amazon.com Announces Second Quarter Sales up 31% to $30.4 Billion.

Just wow. Revenues up 31 percent year-on-year, 30 percent forex adjusted. Like with Alphabet, the forex translations are starting to unwind a little. In other words, relative Dollar strength is all that. Relative, and having been flatlining now for a full year, the comparable over the next two quarters should flatten. Sales at a geographical level are represented at 59 percent North America, Amazon Web Services at 8 percent (I suppose that has no boundaries, the internet) and the balance, 33 percent, one-third, is international. Delivered to places like Mzansi. I use them, do you?

The last four quarters rolling revenues are 120 billion Dollars. Phew, that is sizeable now. Net income clocked 857 million Dollars, we have massaged ourselves to expect very little in terms of profits from the company, so I guess this is going to morph from a "pleasant surprise" to a more regular occurrence is my sense. Earnings on a per share basis clocked 1.78 Dollars. Still, a share price at 768 Dollars after hours (up 2 percent after the earnings release) and 2.16 percent during regular trade, earnings look stretched. I suspect that quarterly profits will have to increase by a factor of three for the stock to trade on a reasonable multiple, relative to their peers. The trick is balance massive investment growth versus expectations of shareholders, you cannot have it all.

Web Services is a small and growing business (relative to the core US business), it is extremely profitable. The media part of the business is growing across the globe (including the US) at low double digits, the business is relatively mature, everyone knows music, books, movies can be downloaded very easily. Electronics and other general merchandise, those sales are growing like gangbusters, 32 percent in the US and 38 percent up year-on-year in the International segment. People want the things online nowadays, you see.

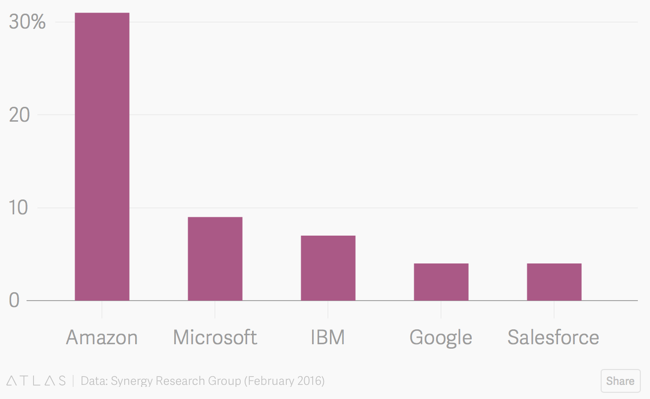

See Quartz and their take on it - Amazon's least sexy business now brings in $10 billion a year. As you can see, people talk about the cloud business of IBM and Microsoft, as well as Google, Amazon dominates, see graph below (thanks Quartz).

The quarter included a big launch in India, Prime (members get shipping free) was introduced with much aplomb into 100 cities, next day or the day after delivery. Which much be harder in India than in many other places, vast population, busy cities and inferior infrastructure to many other parts of the world. Well done for having taken on that amazing challenge. As you can see from the earnings release, follow the link in the first paragraph, the company is incredibly busy.

Churning out original content, AmazonFresh is going to grow like gangbusters (Whole Foods are piloting something similar, announced overnight), even something called Career Choice. Added to new initiatives, all the newer existing businesses are also doing well, the assistant hardware Echo and software Alexa is growing well. Cool product, not available here yet - Amazon Echo.

You are equally owning a part of the future with this company as with Google. This is the future and evolution of data, content and general retail.Buy it with fresh money, buy it if you are underweight the stock. The forecast is really interesting, the profit forecast is very wide (50 to 650 million Dollars operating income) on net sales guidance of 31 to 33.5 billion Dollars. Still ratcheting up really quickly.