Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Visa takes you places. Visa will be in your face over the coming weeks as a Worldwide Olympic Partner, those are two weeks away sports lovers. An amazing thing really, the Olympic Games, this one will of course be no exception. Equally, Visa is an amazing company. Their ability to run a network that will switch your transaction in a single swipe, regardless of whether you are in any of the major cities of the world and regardless of where your bank is. The fact that there can be guaranteed payment to the merchant, no cash ever exchanges hands and your risks are greatly reduced, that part you just take for granted. We don't even bat an eye.

Yet payment methods continue to evolve to the point where no physical card will be produced, you can with your thumbprint exercise your right to acquire the goods. Just like that. Remember travellers cheques? I remember going on Honeymoon with a whole lot (back then a kings ransom) of them, changing them, fees and all. Visa, along with all the switching networks will be at the forefront of the new technologies, nobody wants to reinvent the wheel just yet. Apple Pay still requires your "card", even if in the future you won't ever produce the physical. If you know your card verification value (the last three digits on the back) in many cases you can complete an online transaction without ever having to see your card again.

Visa numbers from last evening quickly, this was for their third quarter. The meet on the revenue line was also met with a beat on earnings, slightly ahead of Wall Street expectations. The company has also made the share buyback larger, to 7.3 billion Dollars. The market cap last evening was 189 billion Dollars, this represents a really large amount, shareholders only feel the impact much later. Fewer shares in issue with incrementally increasing earnings.

Volumes continue to increase in the low double digits, as consumers and governments are encouraged to do more digitally. We often point out that many transactions are still cash in Europe, the more done with cards, the cheaper it gets eventually for everyone. Visa Europe was integrated into the company, the total consideration remember was upfront 12.2 billion Euros, plus an extra Pref share issuance of 5.3 billion Euros and a closing 1 billion plus 4 percent per annum in interest on the third anniversary of closing. In total around 21 and a half billion Dollars. A truly big deal! Part of the buyback is to minimise the impact of the prefs issued here.

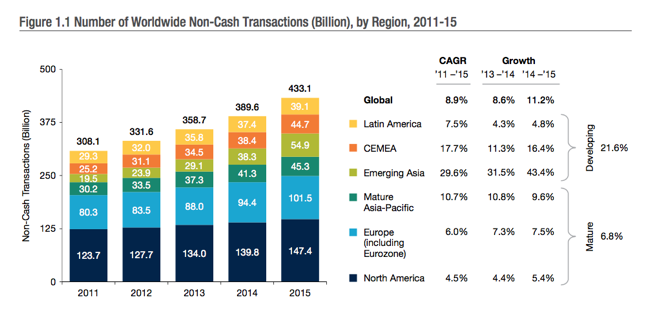

The stock has always looked perpetually expensive. Now is no exception either. Even with guidance given of high single digit revenue growth, margins to die for and the ability to generate free cash of 7 billion Dollars per annum, the market always has high expectations. There are an astonishing 2.5 billion cards out there. According to this report from competitor MasterCard, "cash still accounts for 85% of all consumer transactions throughout the world." A non-cash (i.e. Electronic and Card) payment transactions are understandably at a much lower percentage in developing countries than developed countries. Still, there is plenty of room for growth, as you can see -

We suspect that Visa and the others who operate the networks for switching will continue to benefit from all the switching away from cash. I am pretty sure that cash as we know it is living on borrowed time, at least in more developed societies. The carrying costs are too high, it needs to be guarded and buried in a hole in the ground. Sounds like gold. We continue to accumulate what is a very well positioned business that benefits from globalisation and changing consumer patterns. The stock price is flat after-hours.