Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Johnson & Johnson reported numbers yesterday, before the market opened. I recall whilst reading the history of the company that there were three brothers Johnson who started the business, it could just as easily have been called Johnson Bros. I guess history may have been different and afforded the company a less spectacular path. The business is split into three segments, a devices and diagnostics business (as a standalone the biggest in the world), a well known pharma business which most investors associate with and lastly a business that consumers know and trust well, that covers every thing from bandaids to child care. If you have had a kid in the last five decades I am pretty sure that you have used the clear yellow tinged shampoo and the baby powder. In the US of course Tylenol is a big seller in the children pain department, not without their fair share of issues. Their brands are instantly recognisable, Listerine, Neutrogena, as well as the aforementioned brands.

The CFO came on the box yesterday, he seems like a solid fellow and seemed to suggest that all of their businesses were firing on all cylinders. It is great that a diversified business can see you through all season, although you would expect a business of this nature to not necessarily be prone to business cycles. You are not going to use fewer plasters, less shampoo, less hand cream, not go for that hip operation, or not take that medicine that you need. Those businesses equally don't share the same upside when the cycle turns and consumers buy more "stuff", not necessarily that they always need it, it must be said. And the company never sits still, they have recently acquired a business in their consumer division called Vogue, which catapults them to fourth biggest in haircare, remembering that L'Oreal are the biggest on the planet. Unless everyone decides to stop washing their hair (or shaved hair becomes a thing), the future of the business is pretty bulletproof.

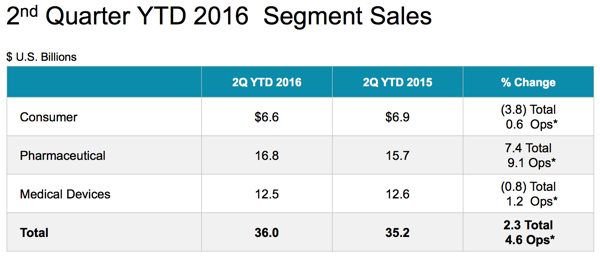

There is a very strong pipeline too, nearly two dozen products in the coming half a decade. As mentioned in the TV interview, the UK is a small territory, less than five percent of total sales, which clocked 18.5 billion Dollars. Adjusted earnings were 4.9 billion Dollars, adjusted EPS clocked 1.74 Dollars, ahead of expectations of closer to 1.68. And whilst both numbers were not heavily ahead of the comparable numbers last year, it was certainly a beat. Pharma has been driving the business, to give you an idea of the divisional split, here is an image grabbed from the presentation -

Amongst all the divisions the company is certainly diversified, inside of those consumer division quarterly sales baby care is 500 million Dollars of sales. 2 billion Dollars a year. Skincare is nearly a one billion Dollar business, OTC trumps the lot, at a little over 1 billion Dollars per quarter. In amongst Pharma, the biggest jumps are immunology and oncology which are their growth businesses, both clocking around 20 percent growth. Immunology is the biggest single contributor, over 3 billion Dollars out of 18.5 billion. In the medical devices department, orthopaedics (knees and hips) and surgery (of the general kind) are nearly 2.4 billion Dollar a quarter businesses.

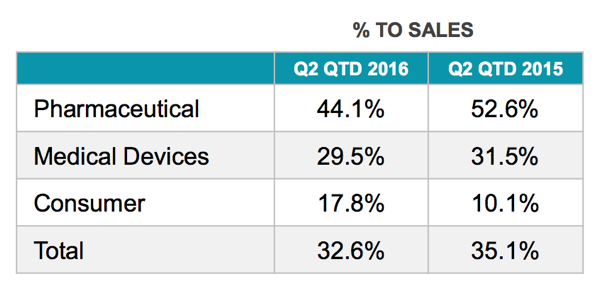

Check the contributions from the separate divisions:

Net income margins have been ticking up over the last five years, ahead of their peers. Research and development expenses are really ahead of their peers. JNJ spends 12.9 percent of their revenue relative to their competition, which spends 11.4 percent. The company doesn't plan to split the business, which may unlock shareholder value in due course, their plans are to continue to expand across their OTC business, Oral Care, as well as Baby and Skin Care. In Pharma, as discussed, their pipeline looks strong. Medical Devices, that is an amazing business, that would continue to grow in time with new and innovative products.

Guidance was decent too, the overall growth is expected with the return to shareholders to be in the high single figures. We like this company a lot, the share price has had a terrific turn lately after a long period of underperformance. Whilst the stock always looks expensive, it possibly is as a result of the unique nature of the split. We continue to accumulate on weakness.