Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

It is Naspers time. It is more than a little complicated when trying to review this business, and that is why there has always been various views on why you should or shouldn't own the stock. At a face value the stock from an earnings point of view always looks overpriced. Not all valuation metrics are the same, you value the business based on the future profitability of the business. I suspect that many investors who try and value this business grapple like all of us to try and value what the likelihood of the increased investment in key areas is likely to yield. In other words, heavy investments currently in their classifieds and ecommerce businesses, mean steep losses for the time being. The longer dated investor may well think that this is very necessary for the business to jump to the next stage of investment.

Around two years ago, Koos Bekker cautioned that the TV business may well be a legacy business, it is old school. With improved internet speeds, the roll out of many more channels (think Netflix and their (Naspers) own Showmax) we are seeing the evolution of TV. What is not quite clear in the whole TV on demand thing is where does sport fit into this. You cannot watch sport second hand. You have to watch each and every match live, otherwise you miss something. FOMO is real, most especially for sports fans. We live in times that evolve, and quickly at that. You are more likely to consume more and more media via your handset. Naspers are there and want to be there. I suspect that there will also be a time when people associate the business with the new chief and less so the chairman.

Let us cover the results in several bite sizes, first today the marked impact of the Dollar in their results. Weakness across the board in emerging market currencies led to Dollar being revenues flat, the Dollar strength had a drag of 285 million USD on core headline earnings. In local currencies revenues grew by 22 percent. Listed investments account for nearly half of revenues, 46 percent to be precise (Mail.ru and mostly Tencent), whilst ecommerce is growing sharply, contribution of 22 percent to overall revenues. And then video entertainment, which is the old school satellite TV and Showmax as the newer kid on the block, that is 28 percent in total. The balance, a mere 4 percent is media and other.

By geography, revenues are 49 percent Asia, 23 percent South Africa (still big), 15 percent Europe, 2 percent Latin America, only 9 percent "Rest of Africa" and lastly "other" is two percent. In terms of where revenues are derived (outside of the segments) it is IVAS (Internet value added services) and Games at 36 percent, subscriptions (to TV) at 23 percent, ecommerce at 21 percent, with advertising at 11 percent. Print, circulation and distribution is a meagre 3 percent, it is a wonder that this business is still called Naspers (loosely translated, National press).

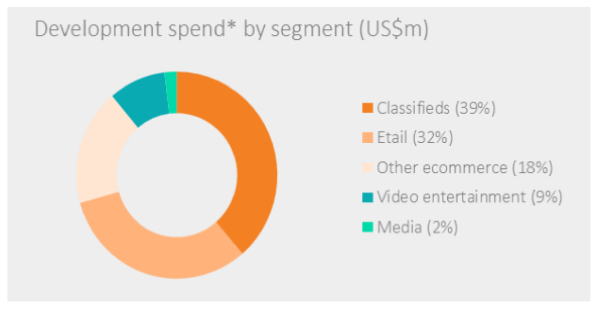

Here is the part that makes it difficult to understand the business, a picture tells 1000 words, in some cases with some iconic ones, more than that. Their development spend is clearly focused on businesses that they think are likely to catch more subscribers and users in the coming years.

Forex swings ate heavily in the absolute development spend in the company, over the last three years Naspers have spent an astonishing 2.265 billion Dollars in their various businesses. In Rand terms that is over 34 billion. So when will these heavy spend yield positive results for shareholders? Perhaps to answer, one has to point out that the company is not always going to get it right. In the most recent results they have written down the value of many assets, including the South American print business Buscape, Konga (an electronic ecommerce business in Nigeria) as well as Netretail, an Eastern and Central European internet retailer.

When you part with your hard earned money and invest in this business, you are leveraging off incredibly smart minds who are following current trends in consumer behaviour and patterns. Think OLX, Takealot, allegro, Flipkart and goibibo. They might not be well known to you, they are parts of other peoples channels. The company will continue to invest in higher growth business models as well as continue to make their respective subscriber bases much bigger than currently. And all of this will take place on the device in front of you, the mobile phone. Why? Increasingly in the areas that the company operates the internet is delivered in that fashion.

We continue to own what is still essentially a proxy for Chinese entertainment business Tencent with maturing other businesses and most importantly very exciting new businesses. This is still one of the best opportunities in our local market, we continue to accumulate this business on weakness.