Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week we had Alphabet Announcing First Quarter 2016 Results. This is only the second time that the results have been released under the name Alphabet. Before that it was known as Google.

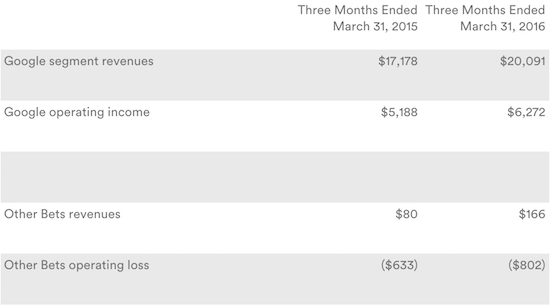

The company might be reporting under a different name but it is still basically only Google until some of their side projects like "Google Fiber" start to make money. When people call Google a "one trick pony" here is why:

As you can see, "Other bets" is a side show at the moment that just costs the company money. I find it amusing that the company calls the non-google component of the company "Other Bets". I suppose you could call a division that costs you around $3 - 4 billion a year in losses a bet. Looking at the grand scheme of things, the investments are in areas that they say are "Disruptors", "Growth" areas and have "global" potential. These bets are being funded by the $75 billion cash pile that Alphabet is currently sitting on. The cash pile is up $2.2 billion since the last quarter.

Here are the numbers, Net income is up 20% to $4.21 billion for the quarter and revenue is up 17% to $20.26 billion, in constant currency they were up 23%. It is clear that the company is still growing at a good clip and is forecast to continue on that track. All this growth comes at a cost, the share is trading on a P/E of 30 but that unwinds to an 18 P/E with the forecast 2017 numbers.

That high P/E also comes with high expectations, so even though the numbers from Alphabet were solid they missed estimates, resulting in the shares being down 4%. Not too bad when you consider that over the last year the stock is up around 30%. The one number that had people concerned is the average cost per click (the money paid to Google every time an ad is clicked on), the average cost per click is down 9%, slower than the 13% decline in the last quarter. Given the increased competition in the online advertising space it is not surprising that the cost per click is declining but there is more than enough business to go around. The number of paid clicks was up 29%..

We are happy holders of Alphabet, going forward there is still growth on the horizon and over the next couple of years their "other bets" segment will start to play an increasing role on brining in profits and more than likely change the way that humans do things.