Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

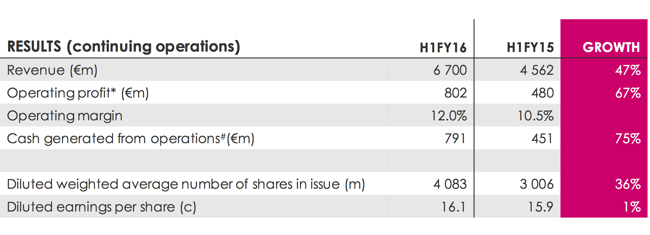

Steinhoff (International Holdings) have been in the news lately. For a lot of reasons. Yesterday the stock touched an all time high, in both the short listed history in Frankfurt, which has been since December last year, and here in Jozi. At one stage the stock was trading at 89 Rand a share, the stock was in the third week of January below 70 Rand a share. The company reported results on Monday for the first six months of their financial year.

This period obviously includes the new home so to speak, with the listing in Frankfurt and the "home" in the Netherlands. As they point out in the presentation, the attraction for the local shareholder base is that 74 percent of profits are generated from the United Kingdom and Europe, on 59 percent of the revenue base. 34 percent of revenues are generated from Africa (25 percent of profits), balance of revenues (7 percent) and profits (1 percent) are from Australasia.

EPS is flat as shares in issue increased sharply, as a result of the Pepkor transaction. Most pleasing, Conforama increased profits by 31 percent, margins widened by 130 basis points to 6.8 percent. The UK business was flat to middling, margins under pressure there. The group is now huge, 6900 plus outlets, 105 thousand employees, looking to generate sales in excess of 13 billion Euros, that is nearly 220 billion Rand in revenues. That is huge!

The company is currently in negotiations to acquire Argos, remember this post from a couple of weeks back: Steinhoff bids for Argos. As recently as yesterday, the news came that the company is now looking to bid against a sizeable European company, Fnac, in order to acquire a business called Darty. In France. Steinhoff Makes $924 Million Proposal to Win Darty From Fnac. I remember that there were only two shops where you could buy anything in Maputo (during the war), one was at Fnac, it was fun to shop there. You needed hard currency to buy there, a store card, and you couldn't be Mozambican, the ultimate smack in the face. There is a weird connection here to French political royalty, the heiress (Jessica Sebaoun-Darty) to the Darty empire is married to the son of Nicolas Sarkozy, the former president of France.

We continue to think that the company will do these deals, Markus Jooste is VERY ambitious and recognises that the time to buy these assets is now. Buy when Europe is seemingly weak and sweat the details really hard. He is great, it is one of the reasons we own the business, a strong and ambitious management team. We continue to recommend the stock as a buy.