Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

We saw the Steinhoff news on Friday, there is confirmation this morning that the company is offering the Home Retail Group (HRG) shareholder a total offer of 175 pence a share. The Home Retail Group website says on the Investor Relations page: "Despite challenges in our markets, we've maintained our multi-channel leadership position and continue to be the UK's leading home and general merchandise retailer." I see. It is a sizeable business, in terms of its depth across the length and breadth of the United Kingdom, over 1000 stores employing 47 thousand folks and selling 90 thousand plus products.

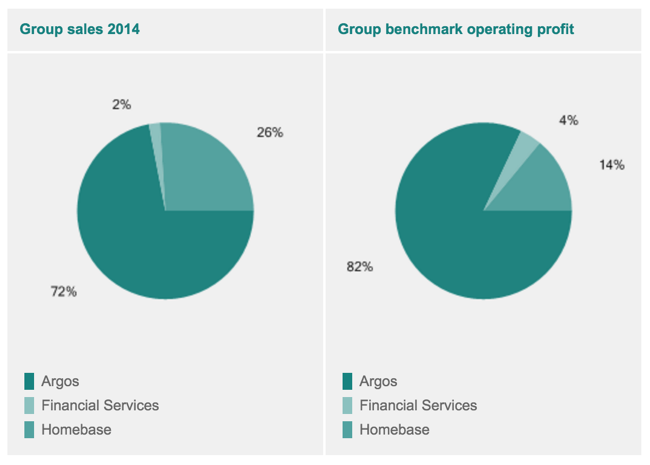

They (HRG) have two brands, Argos, which sells anything from hair dryers to Jimmy Choos and Homebase, which sells everything from paint to plumbing equipment. Homeware and retail, that sounds about right up the alley of Steinhoff. Added to this is a pretty sizeable Financial Services arm, that offers credit to their shoppers. According to the HRG website, they have 1.5 million active card holders and this is the UK's biggest store card business. This is the split of sales and profits:

So how much is 175 pence a share? It is roughly a 15 percent premium to the current share price, 1.4 billion Pounds. The stock is up over 50 percent year to date on the fact that Sainsbury are also bidding for HRG. Steinhoff's bid is 111 million Pounds more than Sainsbury's, around 8.5 percent higher. Also ongoing in the background is the fact that HRG is selling Homebase to Wesfarmers. Complicated. What is also interesting to note is that whilst the Steinhoff offer is higher, it is all cash, whilst Sainsbury's bid is a mix of cash and scrip. In terms of UK company law, Sainsbury have to "put up or shut up" by the close of business tomorrow.

How big is this in terms of Steinhoff's market cap? 1.4 billion Pounds = 1.8 billion Euros. The Steinhoff market cap is 18 billion Euros in Frankfurt, this is one-tenth of their market cap, a sizeable deal by any stretch of the imagination. This signals that Marcus Jooste is really intent on growing and building this empire. We watch and wait to see firstly whether or not Sainsbury will counter, what is most important to remember is whether or not the HRG shareholders WANT this deal to happen. The shareholders have been long suffering, down 38 percent over ten years, down 34 percent over 5 years. Down 15 percent over 2 years. With the 50 percent uptick year to date, this is very tempting.