Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week we had Johnson & Johnson Reports 2015 Fourth-Quarter Results, which were a small beat on earnings expectations but a miss on the revenue side of things. As we have spoken about in previous notes on JnJ, they are basically three companies in one with the following devisions, Pharmaceutical Products, Consumer Health Care Products and Medical Devices.

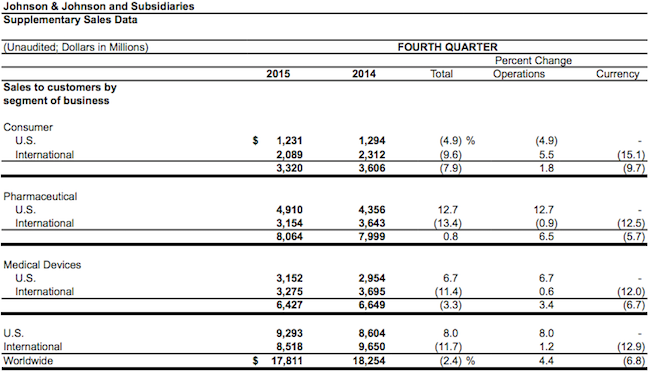

Here is a look at how each division did compared to the 4Q last year:

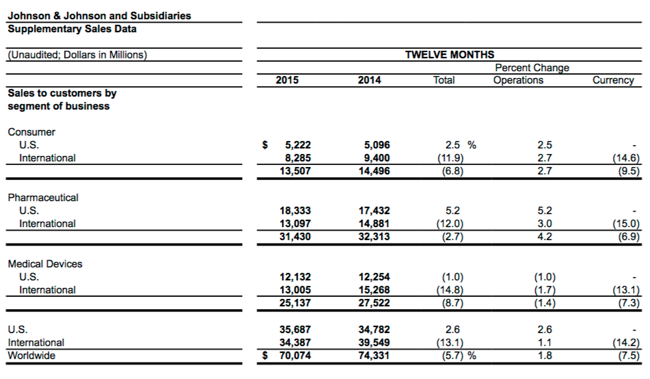

Here is how the full year numbers compare to the previous years:

The first thing that stands out is how big an impact the strong Dollar was on the numbers. The down side to having around 50% of sales offshore is that currency movements have a big impact on overall numbers. When the rest of the world catches up to the US, the numbers will have a huge tail wind from a weaker dollar and increased international sentiment.

Looking to the year ahead, "The company announced its 2016 full-year guidance for sales of $70.8 billion to $71.5 billion reflecting expected operational growth in the range of 2.5% to 3.5%." and " Additionally, the company announced adjusted earnings guidance for full-year 2016 of $6.43 to $6.58 per share reflecting expected operational growth in the range of 5.3% to 7.7%.".

The stock currently trades on a P/E ratio of around 19, which is not cheap considering forward looking growth is only in the single digits. Investors are paying up due to the defensive nature of the industry/company. Helping the bottom line going forward JnJ are shaking up their laggard Medical Devices division with an expected saving of $1 billion in coming years. There is also pressure on the board to potentially spin off one or all of the divisions, which based on investment banker spreadsheets, should unlock value for investors.

Don't expect too much share price appreciation unless some corporate action is announced. We still like the healthcare sector and the stock, adding on weakness.