Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Priceline.com had results the other evening, the market was far from kind to the stock, sending it down by around 9 percent in a single session. It certainly was not as if the results themselves were bad, they were not. First, before we being reviewing those results, what is Priceline and what do they do? Quite simply, through their operating and ownership of brands you know such as Booking.com, priceline.com itself, agoda.com, KAYAK, OpenTable (book your restaurant table) and rentalcars.com they are the biggest provider of online travel and services on the planet.

That is right, the company has a market capitalisation of 66 billion Dollars, quarterly sales in excess of 3.1 billion Dollars, have served 1 billion guests since the inception of the business in 1998. They represent 820 thousand unique properties, which in turn have 21 million bookable rooms, last year alone 285 million people booked through their platforms. And as they point out, 70 percent of the properties that you can book are beyond the "traditional hotel". They can tell what patterns their customers follow, most booked boat holidays are for instance in Sweden, for bed and breakfasts it is Italy, Spain for guest houses, the United Kingdom unsurprisingly for hostel and inn bookings, whilst the US has the highest percentage of vanilla hotel bookings.

That said about the percentage of bookable properties, of the 21 million odd bookable beds, 14.4 million still fit in the hotel rooms category, with vacation home rooms covering 1.8 million. Other unique places to stay fall into 4.8 million "rooms", which includes, as the company points out rustic tents in South Africa (we get a mention), igloos in Lapland, a treehouse in Costa Rica and caves in Turkey. Fancy yourself as a globetrotter? Through the platforms you can find hotels in 214 countries, vacation rentals in 197 and "other types" (including caves, treehouses, tents and igloos) in 208 countries. Interesting that their bookings reveal that self-catering and unique properties continue to grow in popularity, meaning people are looking off the traditional and beaten track. Immersing themselves in experiences rather than physical and material "things".

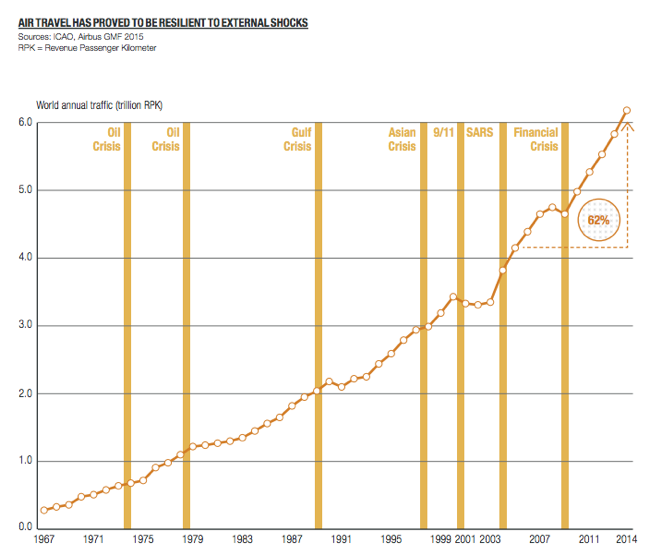

There were 3.2 billion bums on aircraft seats last year (2014), for both business and tourism purposes, both Airbus and Boeing have pretty aggressive forecasts for plane numbers over the next twenty years. There are some stronger zones than others, for instance the number of Chinese flying to the US in-between 2009 to 2012 increased threefold. Easier to travel, richer consumers looking for different experiences. With populations set to grow to 9.5 billion by 2050, and with two-thirds of them living in urban areas, the scope for richer consumers travelling more is heightened. Airbus predict that air traffic will double in the next 15 years, more air travel means more places needed to stay on the other side. Equally, check out from this Airbus on how robust air travel is in the face of some pretty horrid events over the last 45 odd years:

I think that the best thing about the platforms is that real guests can review the place after the stay, during the stay and that helps establishments keep up their standards and equally attract more guests over time. If you are searching by stars, you get the best possible option for the price that you are willing to pay. The company earns its money via a commission structure whilst they facilitate the reservations (from cruises, to cars, to accommodation), as well as for other services of flights, holiday packages and rental cars. They are the platform and the facilitator, hence they are the people who keep a small slice of the pie when there are transaction fees.

It is a very competitive space, competition includes the likes of Expedia (Hotels.com and Travelocity are the brands you will be familiar with), Orbitz (which is about to be owned by Expedia), Airbnb, HomeAway, TripAdvisor (they have a partnership with them), and then of course the traditional and older models of providers. Lets not forget the good old fashioned travel agent who does all the booking for you. These platforms I am afraid are replacing all the traditional platforms, new jobs and more efficient jobs.

Q3 numbers were pretty good, gross bookings swelled to 14.8 billion Dollars, up 22 percent, that was without dollar headwinds. Including the stronger Dollar, a less impressive 6.9 percent growth year over year. Earnings for the quarter were 25.35 Dollars per share (the share price is at 1323 Dollars a share), the main disappointment was that guidance for the next quarter was weak. Total bookings in Dollar terms set to be up only 1 to 8 percent (in constant currencies it is 13-20 percent), you can see how the currencies are weighing on earnings. Of course that changes in time. Earnings for the full year is expected to be in the region of 49 Dollars, and next year the analyst community is modelling as much as 63 Dollars a share, I have seen estimates as high as 69 Dollars. Which means that for a growth company the stock trades on a very undemanding multiple, relative of course to the growth. In fact, the PEG ratio is less than 1. We initiate Priceline with a buy, this is great business with great growth prospects.