Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

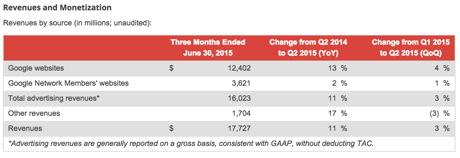

Google has been a serious laggard, in terms of their price performance relative to the market. As I speak to many people about companies it is human nature for us to look at share price performance and translate that to internal company dynamics and quite quickly come to the conclusion that Google "is not doing that well", we are ALL guilty of that. Don't beat yourself up, we all do it. Revenue growth of 11 percent year over year (when measured against Q2 last year), serious currency headwinds in there, constant currency revenue growth was 18 percent. 17.7 billion Dollars in revenues for the quarter is pretty impressive, currency impact was a whopping 1.6 billion Dollars, with the benefit of modest hedging that was reduced to 1.1 billion Dollars. GAAP diluted EPS clocked 4.88 on GAAP net income of 3.351 billion Dollars. 9 out of every 10 Dollars are still from advertising, check out the revenue breakdown:

What the market liked the most however about these results were cost controls. In March this year we wrote about Google's new CFO, who was heading back to her San Francisco roots after an extended Wall Street stint (quarter of a century plus) at Morgan Stanley. She has immediately been credited with this success, Wall Street's estimate concerns on costs getting a little hot have been addressed.

Not that it is the job for Ruth Porat (Google CFO) to pander to the earnings needs of Wall Street analysts, rather her job is to keep spending at the correct levels. Again this represents a certain maturity of Google, whilst there is still a company encouragement of free thinking to maintain the entrepreneurial spirit, it become harder when you reach the size of 70 billion Dollars of annual revenues, with your 57,100 employees at quarter end. Notwithstanding the large workforce, Google still ranks as the best place to work in the USA, Canada and Japan, courtesy of the publication Fortune. And they continue to hire, the number of Googlers increased by 18 percent over the last year.

The company continues to "win" in mobile and in particular with YouTube. The purchase of the video website an age ago is just starting to take off, according to Porat on the conference call: "Growth in watch time on YouTube has accelerated and is now up over 60% year-over-year, the fastest growth rate we've seen in two years. Mobile watch time has more than doubled from a year ago." Who would have thought that people like to watch moving pictures on their smartphones?

As with many technology companies, there is possibly too much cash on hand, 70 billion cash and cash equivalents (58 percent outside of the USA), this amount is approximately 19 percent of the closing market capitalisation. This will be deployed properly to sustain their core search business (they spent 2.5 billion Dollars in the quarter, mostly on data centre construction and for production equipment), as well as their newer and possibly bigger revenue generators of the future, Nest, Fiber and Google Life Sciences.

Nest is a set of smart home products, thermostats, smoke and carbon monoxide alarms, as well as camera monitoring. Hardware. Google Fiber, I want it, 1000 Mbps, Google TV and all that, hardware again. Google Life Sciences, that is a little more secretive. Competing with big pharma, using technology, there are many competing firms in this space. The reason why we own Google is that they are one of the very few companies that are constantly trying to find extra businesses that will benefit humankind, you have to admire that.

In ordinary trade, i.e. in the spot market that is open from 08:30 to 16:00 in New York, the Google stock price (ticker GOOGL) rose three percent to crest 600. After hours the market saw something they liked a lot, I suppose we could call it the Ruth Porat effect. The stock is up 12 percent plus post the market, 675 Dollars. That means, should these gains hold, Google would have finally performed inline with the rest of the NASDAQ and finally we can say that the company (and the stock) is "doing well". Patience and owning great companies, with rosy futures, are rewarded in time. Should the stock open around these levels, it will be a comfortable all time high. More significantly, Google has been a ten bagger since listing. We continue to hold and buy this transformative company.