Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Cerner, the biggest standalone IT Healthcare services business in the world, reported their Q1 numbers last evening. The company is exposed in that they are susceptible to a downturn in healthcare spend on high technological products during an economic malaise. That is what happened to them in 2008/2009, like many other service related businesses. Headquartered in Kansas City and having been around since 1979, the company has seen cycles come and go. What is evident however is that all the money that they have spent on research and development, since the business was founded (36 years), is going to be replicated in the next half a decade. This is truly an exciting time for the company.

What of course has helped their business a lot has been continued technological innovations in the hardware space, i.e. in the same way that many technologies are only as good as the supporting hardware and software around them. Following up from the mesofacts above, healthcare and technology still have not collided in the ways that many patients and healthcare professionals would have liked. Indeed, procedures are met with multiple sets of forms, sometimes the same set of forms. And yet sometimes it still goes wrong, many bracelets and clipboards later. That is where Cerner seeks to eliminate the mistakes, which are all human. Another great example, an investment in technology, which is making us safer and healthier.

What exactly does Cerner do, before we take a peek at their numbers? Lucky for us, there is an about us page on their website, nobody can explain your business quite like yourself, not so? Here goes: Strategic innovation in health care, for today and tomorrow. They have multiple solutions, again you can check out their Solutions and Services, to get a view of what it is that they offer. From digital charts (no more clipboards and paper), tracking medical equipment to ensure maximum usage (ain't nobody got time for a missing ventilator), through to the complete solution, the Cerner Smart Room, the products are designed to bring technology to healthcare. In a nutshell the company manufactures products and software that save time, which in hospitals is quite simply, lives. Cerner saves human lives.

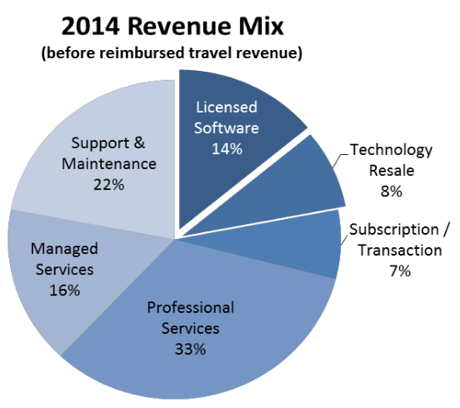

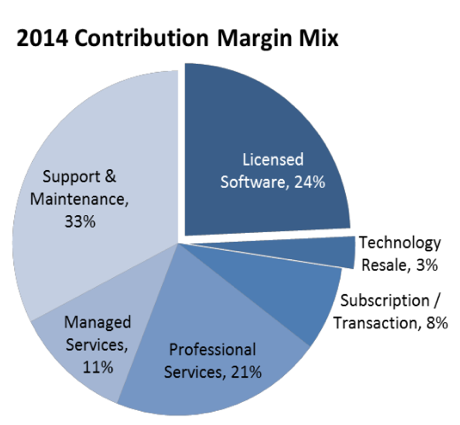

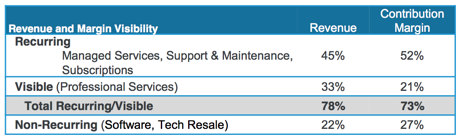

A few pie charts and pictures, thrown in for explaining a little more about this business, first things first, where the company makes their money. As you can see, and refer to the table underneath these two pie charts, whilst from a revenue point of view the recurring businesses are less than 50 percent, in terms of profits they are far higher. Which bodes really well for their business. As you can imagine, there is going to be higher levels of annuity business, as they grow.

Nice. OK, onto the recent results, which were last evening: Cerner Reports First Quarter 2015 Results. revenue was a slight miss and EPS was a meet. The market did not react negatively, bookings are at an all time high, that is why. New clients across the globe. The second quarter is estimated by the company to see revenues of 1.175 to 1.225 billion Dollars (versus 996 million in Q1) and EPS of 51 to 52 cents (versus 45 cents in Q1, which was a 22 percent increase on the corresponding quarter). At 71.25 Dollars you can see that even on FY estimates of 2.11 the stock trades on a 34 multiple, forward. That is NOT cheap. Earnings are however growing at 20 percent plus per annum, the current share price can justify the valuation. We continue to accumulate the shares of what is a very exciting company with equally exciting prospects.