Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

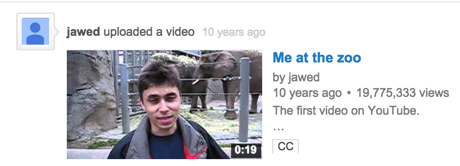

YouTube turned 10 unofficially yesterday. On the 23rd of April 2005, the first ever post titled "Me at the Zoo" was uploaded by Jawed Karim, the co-founder of YouTube. The clip itself is terrible. It is shocking actually. I guess the company has been a success beyond their wildest dreams. Check this out, the first and only ever video, as per below the link.

The other two folks involved with YouTube at the beginning were Chad Hurley and Steve Chen. Chen was born in Taipei and Karim in Germany, (East Germany actually, his family crossed the border). Salar Kamangar is the current CEO, he was born in Tehran, the capital of Iran. Three out of four of the people closely associated with YouTube are foreigners initially to a country they now call home. Sergey Brin, the Google co-founder is born in the USSR. Immigrants founding American companies, there is a massive lesson in that for everyone, most especially here at home.

Why I spoke and am speaking about YouTube is their parent company, Google also released numbers last evening. They were decent, currency headwinds as expected, as much as 795 million Dollars impact on revenue. Google is still a "one trick pony" as many businesses are, that does not concern me. As long as you can display the best trick over and over. Cash on hand, that swelled to 65.4 billion Dollars. Which as a percentage of their market capitalisation is 17.6 percent. The company recorded revenues of 17.2 billion Dollars for the quarter past, which was a 12 percent increase on the comparable quarter in 2015, without the currency headwinds the increase would have been an impressive 17 percent.

Most of their revenues (like Facebook) were derived from their Advertising business, the Google website or the Network member sites. That of course includes YouTube, the Google websites, they have never quite broken it down. Most of the growth in their "other category" revenues were from the Google App store. Those big Android users will know what I am talking about. Top paid Android app in South Africa? Minecraft. Wow.

Now you may view that as sad, in my mind there is no difference between watching the telly and fiddling on your phone or tablet. They are both entertainment, the difference is that when fiddling on your device, it is two way entertainment. You have no control over the content on the TV apart from what to watch, nowadays you are given the freedom of when to watch it. Minecraft? You can partake whenever you want to. What amazes me about that is the lack of the quality of the Minecraft graphics, it is almost "retro". If you needed to know how many potential customers there were for the Google app store, there are more than 1 billion Android devices globally. The most popular apps? You guessed it, Google app (the search), YouTube, Gmail and Maps. Stuff you use every day.

How does Google stack up? Is it expensive? Cheap? Should you buy some shares now? Yes. You should own this company. The company has multiple businesses and when I try and use a comparison of businesses of yesteryear I sometimes suggest that this is the General Electric of the 21st century. They have a strong Robotics business (have you seen those crazy packhorse robots?), they are starting to branch out into medical technological research and partnerships. Lots of their businesses don't or did not work, if it does not, they close it down. Google Labs. Their Ten things we know to be true segment is quite entertaining, their business is still highly connected amongst all your lives. The Nest purchase (for 3.2 billion Dollars) indicates that the company is always on the hunt, for something unexpected. Also, their recent artificial intelligence purchases, DeepMind, which learns from experience is pretty interesting.

Something struck a chord with me, on the earnings conference call the chief business officer, Omid Kordestani said the following, seeing as we (the royal we) take so much for granted: We are also working very hard to make our products more accessible to the next billion people who are coming online. The first computing experience for these users won't see on a desktop machine or a laptop. They will be on a mobile phone from day on one. In fact, many of them will use a mobile device as their only computer.

I suspect that there has not been a time to buy Google on the cheap, since they listed, apart from a period of a year during the great washout of 2008 and 2009. Currently the investment community has the stock on a forward multiple of 19.25 times current year earnings and 16.7 times next years earnings. Cheaper than the index. Market participants have decided that the company has lost its mojo, I guess there are serious competitors in search, Facebook is one of them. Apple phones are awesome, the iPhone 6 is incredible, the Samsung S6 runs Android software, that belongs to Google. Of the high end smartphones, it seems to me that these are the two that get consumers excited. I digress, in summary the stock has never been cheaper, with 55 thousand employees the company may be perceived to have lost their entrepreneurial edge, their core business may be under pressure a little, in that lies an opportunity. Buy, you will have to be very patient, as much as two years patient. Mr. Market agrees, in after-hours trade the stock is up over three percent.