Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday we received full year results from private school operator Curro. I am intrigued by this business because I love the educational theme so I went along to the presentation. Lets first look at the breakdown of this company.

Basically Curro provides private school education from age 3 months to grade 12. They develop, acquire and manage campuses as well as own and run a teacher training institution. As we speak they have 42 campuses with 36 thousand learners. The plan is to grow by 7 campuses per annum to reach 80 schools by 2020 with 90 000 learners. They plan to get there by building schools and acquiring existing institutions.

Within the Curro group there are different types of schools. Curro branded schools are more exclusive and expensive. 75% of the groups learners attended the 23 Curro campuses around the country in 2014. Meridian which is 35% owned by Old Mutual and Curro academy target lower LSM groups but still provide quality education at an affordable price. These campuses average 3000 learners per campus. For the reported period there were 6 campuses. 4 more are in the pipeline for 2015.

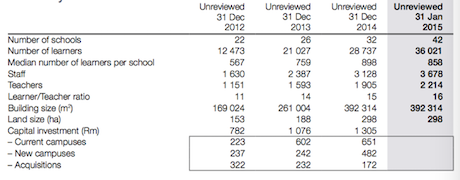

Lastly we have the teachers college. This was developed so as not to poach quality teachers from the state. It turns out that training your own teachers is great for your employee supply chain and can also be a profitable operation. There is 1 campus at this stage. 2 more are in the pipeline within the next 5 years. Below is a table which shows school and learners growth.

Lets take a look at the results for 2014. Learners were up 37% to 28700, revenues crossed R1bn for the first time and EBITDA was up 68% to R192m. This all equated to headline earnings per share of 17.7c which is up 38%. Not bad when you consider that they did a rights issue last year. Trading at R33 this is not a business you should attempt to value on a fundamental basis because it is still growing so fast. Although it does tell you that the market expects a lot.

It turns out that education is a very profitable business, especially when you get your occupancy levels up. In 2014 there were 7 campuses with an occupancy rate of less than 25%. These schools had an EBITDA margin of -9%. 6 campuses had an occupancy of between 25%-50%. These schools were already in profit with EBITDA margins of 18%. 10 schools had an occupancy of of 50%-75% with an EBITA margin of 27%. 9 schools with an occupancy of 75% and above had an EBITA margin of 32%. These 9 schools brought in 59% of the groups profits.

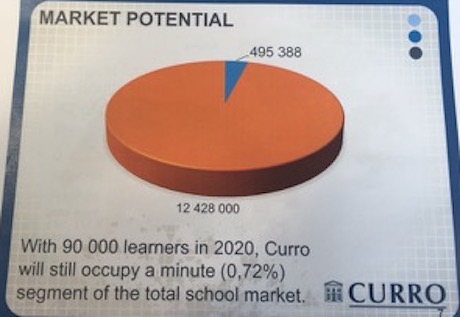

So the big question is, can Curro carry on building and acquiring schools while keeping occupancy levels up? The short answer is yes and this pie graph tells it all.

The blue sky potential within the South African market is huge. Demand will not be an issue for such an essential service. And I am very happy with the guys running the business. Dr Chris van der Merwe who runs and started the business as a teacher took the presentation. He is a teacher at heart and you can see he does this to make a difference, not just for the money. And I feel that they will make a difference for education in South Africa which is nice to know as an investor. Having PSG as 57.5% shareholder is also a great financial backing and their influence should help when making acquisitions. They plan on doing another rights issue for further acquisitions. I recommend a buy on this stock.