Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

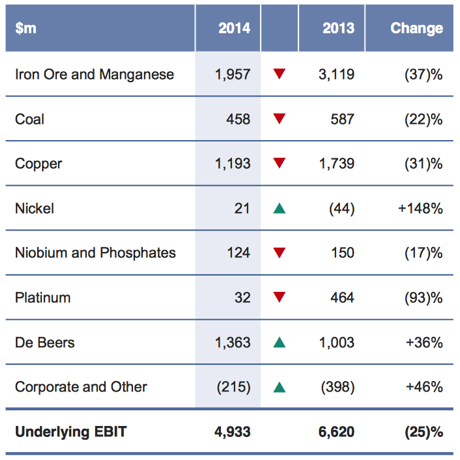

Anglo American released their results on Friday. Iron Ore, predictably falling sharply, still very profitable for the group however, diamonds were an investors best friend, De Beers being the most profitable unit for the commodities company. I guess I could have used the word giant, perhaps Anglo once were the biggest and most talked about company here in South Africa, that bias definitely still exists. With a market capitalisation of 305 billion Rand, it is still a huge company by South African standards, in London the market cap is 16.69 billion Pound Sterling. It is enough to make the FTSE 100, in terms of market capitalisation however it has a weighting of about 1.1 percent. They are currently in 32nd place, BHP Billiton Plc are twice the size (add in the other Ltd. and then it is roughly four), Rio Tinto are two and three quarter times bigger, Glencore Xstrata are a little over two times bigger. The mighty, which once was a contemporary of the others and in most cases superior to the others has slipped in size and scale. Management? Bad decisions associated with management? Assets relative to their peers? Perhaps all of those things. Here is a quick snapshot of their underlying EBIT

If you download the results presentation and the associated graph next to this table above. You will see that in the last year, according to Anglo, their mix was a lot better. My observations are simple, if you like diamonds as your favourite commodity, it is far easier and the margins are better to own a manufacturer of jewellery (who uses the raw products) than to own the people that mine it. For the time being. That may change, for me however it seems that if you are buying Anglo to benefit from a later consumer cycle, I think that there are far better consumer businesses to buy. If you are looking for a commodities business, equally I think that there are better businesses to own, two of them locally here. I suspect that there is locally a need that you MUST look at the company as an investment for historic reasons. I wish the company only the best, what they do is very hard, Mark Cutifani has done a good job so far in repair work, let us hope that him and his team are right about their commodity price predictions, which look very bullish.