Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week we received fourth quarter and full year results from GE. I must say their investor presentations are great. I guess they have to be for such a complicated business with so many moving parts. Here is the presentation if you would like to have a look. Lots of images, graphs and tables to simplify things.

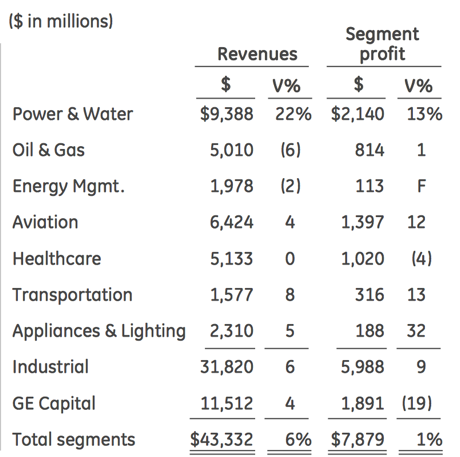

Sometimes GE's diversification is its curse. As you can imagine, oil and gas orders have declined yet their aviation business has shown solid growth. Both are a direct impact of movements in the oil price. Here is a table which illustrates all of GE's businesses and comparisons to Q4 of 2013.

As you can see GE capital is slowing. This has been done on purpose as they sell off segments of this business and become less reliant on banking activities. The company believes that more stable and predictable industrial business is far better for the company. GE capital was still responsible for 24% of profits in the quarter and 42% of profits for the year. Management want to get this down to one quarter of earnings in 2016.

For the full year the company made $16.7bn in operating earnings. This equated to $1.65 per share which was up 1% from the previous year and came from $148bn of sales (up 2%). The share trades at 14.5 times earnings and a solid yield of over 3%. The company is not growing very quickly but it's price correctly reflects that.

]There certainly are positives to take out of the release. The order book is growing at 3% and the cost cutting they are doing has done wonders for margins (up 50bps for the quarter). GE is still very much a US company and the strong economy is expected help GE grow sales by 2-5% for the year of 2015. With strong cost cuts this should bode well for earnings growth. Expectations are for 6% growth in earnings per share to $1.73 for 2015. That is solidly above inflation in this low interest rate environment.

The business is moving in the right direction with more focus on aviation, medical devices, transport and their biggest segment, power and water. The power segment involves the supply of electrical power which actually benefits from lower oil and gas prices. As you can see from the table above, Oil and Gas contributed 10.3% to profits. Not tiny but the company will certainly be able to deal with a slow down in demand for drilling products.

The company has also been very active in the acquisition department. The much publicised $17bn Alstom deal is still awaiting competition approval from the European competition authorities. They are buying the French companies energy division which again targets power generation, a segment you would expect to constantly grow as populations get bigger and people get wealthier.

All in all the company is working very hard at managing the the things which they can control. Operationally and strategically I feel they are moving in the right direction. Unfortunately the demand for their many products remains volatile. I wouldn't call it a conviction buy but I'd be happy to hold and benefit from the solid yield.