Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Facebook. Most people, even your grandmother, has heard of it. Do you not want to be friends with your grandmother on Facebook, what is that all about? The service works seamlessly in the background whilst many users of what has become a transformative and useful service are not too aware of the company dynamics. I mean that from a profitability point of view. Sure, you know that Mark Zuckerberg is crazy rich and just around 30 years old, you know his wife is Priscilla, they live in a fairly modest suburb considering his personal wealth. His dog, Beast, has many more likes (2,127,338 when I checked this morning) than your business or organisation is likely to have. Beast last posted on the first of January, before that in September, when it was bath time. The truth is, and Facebook confirms this, people are interested in people and their goings on, the conversation does not have to be Philosophy 301.

Last evening Facebook reported results, you can view them, of course via their IR website which looks distinctly like Facebook itself -> Facebook Q4 and Full Year 2014 Earnings. There are some important metrics. Can we have a look at the quarter and year separately, mostly as a result of the company growing so quickly. Annual revenue grew by 58 percent from the prior year, operating income grew to 4.994 billion Dollars from 2.804 billion the year prior. Net income for the year nearly doubled to 2.94 billion Dollars, operating margins grew from 36 percent to 40 percent in 2013 to 2014. On a per share basis, excluding special items and stock compensation, EPS grew from 93 cents to 177 cents. The stock I guess is still steeply priced at (the after market price) of 74.85 Dollars on a 42 multiple. On a GAAP basis (nerds unite, we're moving to convergence), the company earned 110 cents, the multiple is a more eye popping 68 times.

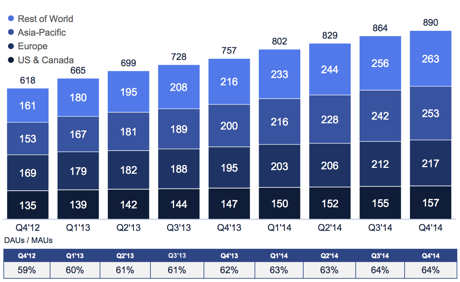

Number of users, that is important right? And I guess that the daily users, which as per the slide below, from the slide presentation represent 64 percent of average monthly users. Daily users are exactly that, daily users. They are pretty much across the globe too, well represented across all territories, as per the slide below:

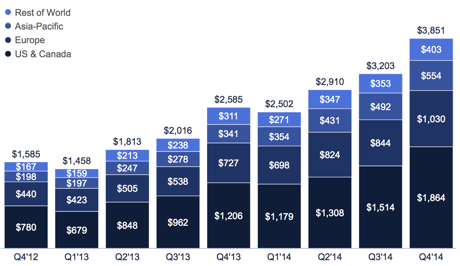

Not all two customers are the same, different territories and societies adopt different methodologies either quicker or slower than one another.

There are more users in the faster growing and more populated Asia, on a per revenue basis however, the North Americans (US and Canada) absolutely smoke the rest of the world. The Facebook ARPU measurement is a pretty standard one, it is a monthly number. On that measure, the geography that we fall into Rest of World, registered a pathetic 94 US cents, per month. The US and in Canada, that is 9 Dollars per user per month. There is plenty more scope for growth here across all of their territories.

And then the number of users, as per the prepared comments from chief, number 1, Mark Zuckerberg: Facebook 4Q 2015 Earnings Call Transcript: "1.39 billion people now use Facebook each month and 890 million people daily, an increase of 165 million monthly actives and 133 million daily actives this year. Time spent per person per day across our services continued to rise, growing this quarter by more than 10% compared to last year and this doesn't even include WhatsApp, which joined us late last year. "

I think that point is well made. When we think Facebook, we do not thing Instagram and particularly not WhatsApp. And almost never Oculus, which certainly does have the opportunity to change the way that we do a lot of business. You can get all of your executives to stick a set of the glasses on and "meet" across the globe at a much lower cost in terms of time and resources. Cisco of course has great technology in terms of the virtual boardroom, I think that this application has many more uses, mostly entertainment.

The stock ended lower in the aftermarket, the jump in expenses is the problem. The headcount grew 45 percent last year. Wow. Research and development costs have jumped sharply, as have marketing and sales costs. These are concerns for short term watchers, however, if you have not been convinced, let me try convince you quickly. As Michael said across the desk, they are not concerned about building a business for the next quarter, they are building a business for the next decade and beyond. The IPO was a disaster, they said. Well, the stock has doubled in less than three years, the company would not think, looking back that having raised money at a higher price was a disaster, now would they? They would not monetize mobile, remember that? Well, the company reported last evening that mobile ad revenue was 69 percent of total ad revenue, fancy that!

Facebook is changing the world. There was a Deloitte report, titled Facebook's global economic impact, which "estimates that through these channels Facebook enabled 227 billion Dollars of economic impact and 4.5 million jobs globally in 2014." Of course for you, the investor or potential investor it matters that people start using advertising more aggressively. The nature of the beast is progressing, the Zuck said five years ago it was mostly text and photos. Nowadays it is photos, a little text and videos. In five years time we may get used to the idea of updating our life and uploading videos on the fly, provided the bandwidth costs are cheap.

Facebook is starting to morph into a company with different irons in the fire, Oculus is potentially an entertainment revolution, to sell that many could be a huge challenge. They, Facebook, have only owned Oculus for 10 months. Give them time. If you think the Zuck is really the man to continue to drive this business to new heights, it will continue to attract users, this business is ONLY 11 years old next week, 4 February. Mark Zuckerberg is young, exceptionally talented and a visionary. Like Facebook, stronger cashflows in the future, they have the potential to change the future. We continue to buy.