Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

BHP Billiton production report yesterday, perhaps the biggest focus point for many people was (as anticipated) a strong fall off in the amount of oil spend, with regards to their business. The full operational review can be downloaded from their website. The must knows are that overall group production increased by 9 percent, driven primarily by Met Coal, Iron ore and Petroleum, Copper showed a decline, as a result of lower grades. The sad truth is that whilst we see all of these production ramp ups, they come in the face of a really precipitous fall in iron ore and more especially petroleum prices. Equally copper, albeit by not as much as the others. The company chief, Andrew Mackenzie said that the cost saving initiatives are faster than anticipated and will help against lower prices. Equally however the number of rigs operated across their US onshore business (read Shale) will drop 40 percent (around 10 rigs I think) and that the higher margin Black Hawk acreage will be all the company focus. The cost for the company (and you the shareholder) is 200-250 million Dollars, US.

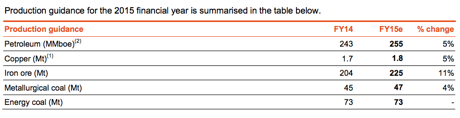

Guidance? Here goes, a screen grab from the report:

The first thing that you will notice is that the business guidance is given without the South32 business, which will be unbundled during the course of March, around 60 days time. Important in all of this is the ability of BHP Billiton to meet their dividend. I have seen research reports suggest that BHP might see earnings fall to the region of 140 US cents this year and then 130 US cents next year (2016), the dividend of around 120 cents might be met. Normal dividend cover of 2.1 times cover would go out the window, this would be a case of using almost all earnings to payout shareholders, borrowing aggressively to meet the projects that make most sense. So, at current levels of around 250 Rand, with an exchange rate of around 11.50 to the US dollar, Rand earnings and dividend expectations (from what I have read and seen) are around a yield pretax of 5.5 percent (very good) and a price to earnings multiple of 15.5 times, a bit out of whack historically with an earnings plunge. As ever it is very hard to predict where to next, with regards to commodities prices.