Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Everyone is back at work now, so lets take a look at how our investments performed in 2014, and ponder what might lie ahead for us in 2015. We will touch on both our Johannesburg and New York portfolios.

Investment performance

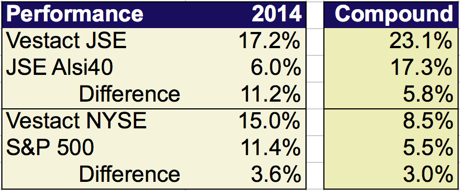

Our JSE model portfolio, net of all costs, rose by 17.2 percent. This compares most favourably with our benchmark JSE Top 40 index, which only gained 6.0 percent.

Our outperformance was mostly due to superb gains from Naspers and Aspen, two core holdings. Also, we had less resources/commodity exposure than the index.

Our compound (annualized average) return in Johannesburg over nearly 12 years is now 23.1 percent per year, compared to the benchmark, which returned 17.3 percent on average during that same period.

Our returns include all costs and dividends. The index returns are measured without dividends.

We are very proud to have delivered long-term index beating returns (this is very rare in the investment industry).

In New York, our model portfolio gained by 15.0 percent in 2014, which is ahead of the S&P 500, which went up by 11.4 percent for the year.

Our top performers there were Apple, Nike, Facebook and Visa.

Our compound (annualized average) return of New York portfolios over nearly 10 years is now 8.5 percent per year, compared to the S&P 500, which returned 5.5 percent on average over the past decade.

Our superior returns are due to sound investment processes and low costs

2014 was a tricky year for active investment managers, it seems. A report I saw noted that as few as 10 per cent of active managers in the US managed to beat their benchmark. So how do we do it?

We stick to well thought-out investment themes: technology, emerging market consumers and healthcare. We pick the best companies in these sectors and hold on to them for the long run. We don't trade share prices, we provide capital to real businesses with bright prospects, and get paid with dividends and with rising share prices.

We try to avoid complacency, and are always on the lookout for new investable themes.

We charge low advice fees of 1 percent of your account value per year, plus Vat, with no performance charges. This is cheap by the standards of our industry. In fact, costs are the most important determinant of investment returns, so it's just as well that we are not greedy.

Our assets under management are now just over R2,1 billion.

Outlook for 2015

We are positive about the future, as usual! The economy in the USA is growing strongly. China is still expanding at a good clip (albeit slower than before), and also improving the balance of its economy. Europe is slowly returning to expansion. India is getting its act together finally. Africa is progressing off a low base. Brazil is battling. Russia is driving its economy into the trees. You can't have it all!

Strange things keep happening in the world, but they are mostly irrelevant to investing. After a few weeks they are forgotten. Keep moving and stay optimistic.

Vestact in the Media

For other real time insights follow all of us on Twitter,: @paul_vestact, @sashanaryshkine, @byron_vestact and @mwtreherne. Or follow Vestact on Facebook.

We are on TV more often than the Kardashians! I host the Hot Stoxx TV show every working day on CNBC Africa (channel 410 on DStv). It airs at 20h00 every weekday evening, and is re-broadcast at 8am the next day.

Sasha is the regular market commentator on CNBC Africa's Power Lunch show on Mondays. Byron fulfills the same role on CNBC Africa's Closing Bell on Thursdays. Michael is on CNBC Africa's Open Exchange on Fridays. Sasha, Byron and Michael also appear regularly on eNCA, eTV and SABC 3.

I also do a weekly feature called Business Blunders at 18h30 pm on the Money Show with Bruce Whitfield on Radio 702.

Get more invested

This is a good time to add to your investments with Vestact. If you do not yet have an account in New York, contact us to open one. If you have family members, colleagues or friends who would like to become Vestact clients, let us know.

Best wishes

Paul Theron

paul@vestact.com