"first of all, the company is investing heavily in their businesses, 4 billion Rand to be exact, up 35 percent from the comparable six months. Here is the revenue spread, Internet is 58 percent of revenue, Pay TV business represents 32 percent of revenue and the balance (10 percent) is Print. That is likely to be less and less in the coming years, trading profits at the print business was 96 percent lower than the prior reporting period."

To market, to market to buy a fat pig. A very, very modest gain for blue chips on Wall Street last night, the other indices, it was a whole lot better, including for technology stocks. I bet it is just a matter of time before we start seeing the headlines like "market fatigue setting in" or "bulls running out of steam", or perhaps there will be the good old Santa Claus rally, as mystical as the bearded man himself, for the kids that is. I am planning to get little, I have everything, right? We can always have new things, whether or not they are useful, that is another story. Mr. Market saw another closing high for both the S&P 500 and the Dow Jones Industrial, the nerds of NASDAQ have around 300 points, or 7 odd percent from here to reach an all time high.

According to the WSJ markets data page, the NASDAQ trades on a 19.85 times multiple forward, the S&P 500 on a 17 times multiple forward, meaning that the earnings of the collective shares relative to their weightings, versus the index level, which can be seen as a price. We can work backwards, the S&P 500 closed at 2069, divide by 17, you get to 121.7 Dollars. The yield is only 1.9 percent currently on the S&P 500, versus the ten year yield of 2.304 percent. You can see that something has happened here, the market is expecting better and better from corporate America, and by corporate America essentially I mean all the listed businesses there. The UK and the local market are strikingly similar in that many of the listed businesses in London and Johannesburg do not represent the economy, that is not so much the case in the US, around 70 percent correlation there. Japan seems highly correlated.

To finish off, the local market was once again dragged back, the same stocks that pushed us forward in a rush on Friday, resource stocks closed the session down 2.33 percent to send the overall market down one quarter of a percent on the day. There was decent enough data from Germany, confidence numbers from a business point of view, the IFO numbers. I also saw that the Russian finance minister had said that the sanctions and a 30 percent fall in the oil price had cost the country a whopping 140-150 billion Dollars. Wow. 100 odd billion for the fall in the oil price (lost revenue) and the balance, around 50 billion being the impact of sanctions on Russia. Imagine if nobody bought energy from the Russians? That would basically mean that their economy would flatline, the country has the most incredible prospects and resources, vast forests vast deposits of minerals and oil and gas, we do certainly need the Russians.

Having said that, the combative nature of Putin and the insiders are worrying, I did read a short piece written by Nouriel Roubini, titled "Russia: 21st Century Empire?" which was emailed (I couldn't find the web link, must have signed up some other way) in which Roubini described personal experiences of having visited Russia and was snubbed by the inner circle. Roubini described how himself and Ian Bremmer had a meeting with senior policymakers in Moscow, arrived and those same said folks who had committed to meetings suddenly cancelled. Even more reason to use Google hangout, or Apple FaceTime or webcams. Cheaper and at least it gives you that opportunity to "see" one another and learn more before you commit to a physical meeting. The reason for the snub on Roubini and his mate Bremmer? They had written an article in the FT criticising Russia for being on the wrong path. One line sums it up in the Roubini email:

corruption in Russia has become endemic to the political system. Sounds familiar.

What are the implications of corruption? According to corruption watch ->

Economic impact of corruption:

corrupt activity hinders development, contributes to the depletion of the public purse and distorts markets - further hindering local and foreign direct investment. In broad terms Transparency International calculates that investing in a "relatively corrupt" country compared to an "uncorrupted" one is some 20% more costly. The direct economic impact is obvious: investment is critical to job creation and poverty alleviation goes elsewhere. That cost is "hidden" and defies calculation. There goes, and once deep rooted in society, it is difficult to shake. There is of course a way of unleashing the human element (call it greed) by imposing fewer restrictions, normally corrupt societies have very many parameters and restrictions, hence the reason for skirting around the rules, buying people off and of course political backstabbing and nest feathering at the publics expense. That is another story entirely.

Naspers released their 6 months number to September this morning, these results were so highly anticipated that I hardly slept last evening. No, not true at all, I slept like a baby, you know, I woke up every three hours crying for food. Naspers are a business in another transitional phase, they are setting themselves up to become a major ecommerce player globally, and of course becoming more dominant in the mobile space, the whole idea of shopping on your phone. Naspers have a whole lot of interesting slides in the

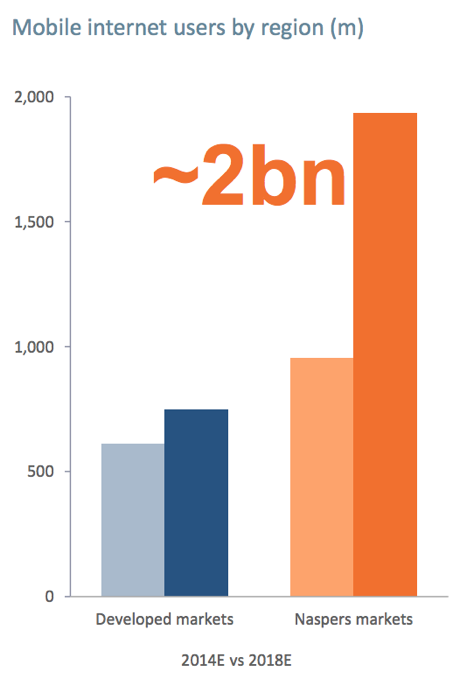

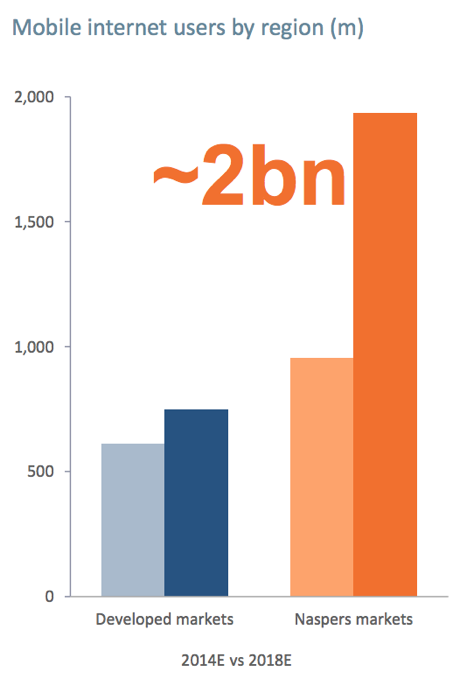

Financial Results Presentation, including the one that suggests that in emerging markets there could be more than double the number of mobile internet users in the developed world in 2018 than currently. They measure that against a relatively flat number in developed markets, here is the slide that I am talking about:

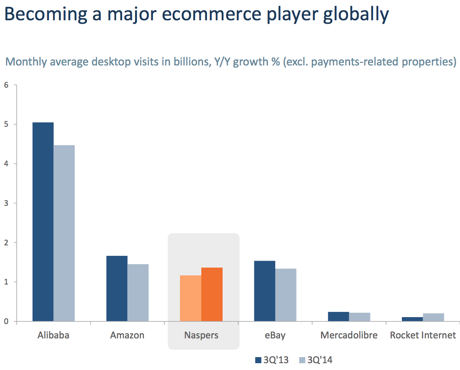

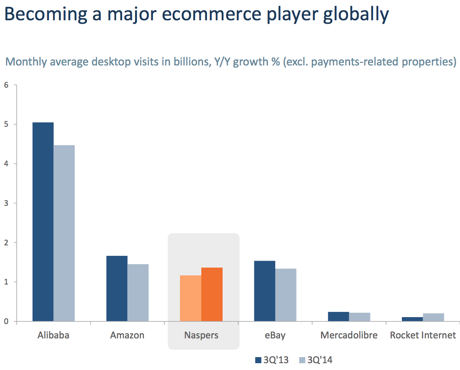

They really, really push the ecommerce part of their business, the first part of the results presentation is dedicated to this next big push in their businesses history. Koos Bekker has made that clear, we should not be that surprised. There was however one image in the slide presentation that caught my eye. It was this one:

So who does that include? What I mean by that is, who and what are the Naspers ecommerce businesses, remembering that the others are single platforms that are well know globally. Kalahari you will know and recognise (they have just teamed up with Takealot), flipkart in India you may have heard of, Souq in the Middle East is making progress, the European businesses (markafoni, emag, mall.cz and esky are amongst the ones in Europe) and avenida in Argentina. Konga in Nigeria. Yip, it is all happening in places that do not necessarily have english as their first language and if you cast your eye back up to the first image, it is happening away from where those others operate. The ecommerce business is bleeding money at this point in time,

trading losses for the six months of 2.426 billion Rand was recorded.

Of course there is the small matter of a growing classifieds market too, OLX is surging, operating in more than 40 countries across the globe, 8.5 million monthly transactions, 11 billion monthly page views (JUST BROWSING!!!), 200 million active monthly users with 25 million new monthly listings. Wow. Yes, they, Naspers own this too. The growth in the number of listings on OLX are mind blowing. Of course this is mostly at a standing start. In terms of the countries that OLX operates in, they are number 1 in 8 of the top 9 countries by population, the only one missing is the USA. Who wants to fight against the biggest rich population in the world? 58.com in China, OLX in India, Indonesia and Brazil is the top dog. Collectively Naspers' classified businesses cover around 3.9 billion people in the most populous states in the world. That is potentially a lot of people, remembering of course that eyeballs do not translate to transactions, which would translate to profits!

The numbers, what do they look like? First of all, the company is investing heavily in their businesses, 4 billion Rand to be exact, up 35 percent from the comparable six months. Here is the revenue spread, Internet is 58 percent of revenue, Pay TV business represents 32 percent of revenue and the balance (10 percent) is Print. That is likely to be less and less in the coming years, trading profits at the print business was 96 percent lower than the prior reporting period. And to think that the local business is in far better shape than the international segment, Brazil sucks, the Abril business lost over 100 percent more than in the six months to September last year. Notwithstanding the fact that the ecommerce business made a loss, the internet business now generates more for Naspers than the TV business, mostly as a result of a 59 percent jump in the Tencent share of trading profits. We didn't even discuss or look at carefully (in this piece) the payu, the payments system, which is growing like crazy.

So what do you need to know here as a shareholder? First and foremost, the company now has 72 percent of their revenues earned offshore. True story. Yet, it always seems like a proxy for Tencent, the Naspers share price. What you get right now is a new business, a business again in transition that basically has this ancient (by media standards) legacy media business, a maturing TV business and the exciting part, the ecommerce and classifieds business, that is what Naspers are investing in heavily. The share price and the valuation part is always tricky, this is a sum of the parts calculation, something that we will again be looking at in detail over the coming days. We continue to recommend this company as a buy.

WHOA! This is big. No, this is huge. Two listed companies and another "Titan" of South African business involved in both legs have announced this morning that

Steinhoff will be acquiring Brait's 37.06 percent interest in Pepkor for 15 billion Rand in cash (now you know why they raised the money - 18.2 billion Rand in August) and the issuance of 200 million Steinhoff shares at 57 Rand a piece, total consideration of 26.4 billion Rand. Not so long ago Anchor Capital valued the stake at 28.066 billion Rand, Brait seemingly sold at a discount. It does not stop there for Steinhoff, they acquire Titan Premier Investments Proprietary Limited's shares in Pepkor, which represents 52.47 percent of the company, which will be bought for 609.1 billion ordinary Steinhoff shares. And then Steinhoff will buy 2.81 percent from Pepkor management to own 92.34 percent of Pepkor. The balance will be held by Pepkor management (they obviously wanted to cash in some chips). This values Pepkor (enterprise value) at 73.382 billion Rand.

Dr. Christo Wiese effectively through this transaction will have 19.9 percent of the shares in Steinhoff. Note how he (Wiese) through his companies, Titan and Thibault - controlled by the family trust, took shares, no cash. The Brait NAV rockets northwards (through the Steinhoff holdings and cash) to 61.35 ZAR, currently trading in the market at 72 Rand, down 18.59 percent on the day at that level. Huh? The Steinhoff discount, I guess, Steinhoff trades on a 12 multiple (historic) currently, way below the rest of the market. Keep that in the back of you mind for when we explain, why Christo Wiese would have done this.

According to the last annual report from Brait (pay attention here), their anchor investment in Pepkor was valued on 4 July 2011 at 4.1 billion Rand. An effective 6 bagger in just over four years, seems good, not so? They reckoned (Brait) that their 8 time EV/EBITDA multiple (enterprise value divided by earnings before interest, taxes, depreciation, and amortization) was a 31 percent discount to their peer group, consisting of Mr. Price, Truworths and The Foschini Group. Pepkor was 60 percent of the Brait NAV as at 31 March 2014. Pages 14 through to 17 in the last

annual report.

Pepkor is of course Ackermans, PEP itself, Shoe City, JayJays, John Craig, Dunns, Flash (nope, never heard of it, yet it is in South Africa!), Power Sales, Best & Less, Harris Scarfe and PEPCO. PEPCO is in Eastern Europe (9 percent of group sales, mostly Poland) whilst Best & Less and Harris Scarfe down under account for 23 percent of group revenue. The rest is Africa, mostly South Africa. 38.2 billion Rand worth of sales. In their peer group, Mr. Price had half year sales of 7.9 billion (market cap of 61 billion Rand), Truworths 10.8 billion Rand for the full year (market cap of 30.763 billion Rand) and The Foschini Group recorded half year turnover of 7.3 billion Rand (market cap of 29.962 billion Rand). Obviously the margins at Pepkor are lower, a bit of perspective however is required in terms of retail sales, Pepkor is a monster relative to these listed businesses.

Dates? Brait shareholders vote on the 27th of January. If that is successful (results immediately), then I guess Steinhoff shareholders will vote, no dates yet, an indication that we will know closer to the middle of December.

Who scores if the deal is sealed by all concerned, the takeover regulation panel, the JSE and the shareholders all give the thumbs up? Who scores? First and foremost, Christo Wiese (the good Dr.) externalises a large portion of his local wealth, if you think about it, prior to the Steinhoff intended acquisition (as per the Steinhoff release):

"the proportion of revenues and operating profits that Steinhoff generated from its non-South African operations were 74% and 90%, respectively." He is willing to give up the premium in Brait for the increased Steinhoff stake. And if you were not convinced, Wiese has worked hard to see the Invicta (a business he owns a lot of) spread their wings offshore. Of course along with the Invicta management, just a side note.

If the Frankfurt listing goes ahead, the investment in an African and European emerging markets retailer, which has a strong foothold in developed Europe would be appealing for German investors and the broader asset management community there. Steinhoff shareholders would be winners, that means Wiese, Bruno Steinhoff, Klaus Daun, Markus Jooste and others would see a PE expansion lift their personal wealth. What I am trying to say is that when the listing goes ahead in Frankfurt, there should be a slightly higher valuation (I think) given to Steinhoff in Germany. Good for Brait? Certainly not in the short term, absolutely caned. Obliterated.

I guess the Brait shareholders are telling you that they do not want their Pepkor shareholding to be a part proxy for Steinhoff, they can buy Steinhoff in the market. Plus, lots of cash and not the big premium. We will see how they vote, and by they, I mean Brait shareholders. 7 shareholders of Brait (Directors) own 35.12 percent of the shares in issue. The GEPF hold 11.68 percent. I think that this will pass on their side. We wait, this is interesting.

Things that we are reading, that we think you should be too

Coca-Cola's new direction -

Coca-Cola Is Betting Big On A New Kind Of Milk That Costs Twice As Much As Regular. As people become more health conscious I can see a premium milk product working, that is if people don't perceive the premium milk as too much of a divergence from regular milk.

If you want an idea of what next year holds for markets and commodities this slide would be one of your best bets -

Goldman's Entire Outlook For The Markets And Economy In One Slide. Good news for the consumer is that Goldman sees the oil price staying around these levels for the next year. I'll save this slide and we can revisit it next year this side and see how close or far Goldman was. The only certainty about these forecasts is that the numbers will ultimately be wrong if you are looking for 100% certainty.

Forecasting and valuing a company is not an exact science, with a listed stock you know exactly what the market thinks a company is worth at any given second. A companies "true value" is probably with in a 10% range of where a share trades, so daily moves have more to do with emotion than actual value change -

The Smart Way to Think About Wild Markets.

Having a look at what the stocks that have doubled in value this year have in common -

60 Stocks More Than Doubled in 2014 So Far. You wouldn't base an investment decision on what the overlaps are, it is interesting though to see what the market is giving a higher values to.

Some more facts on the increased spending power that consumers will have given a lower gas (petrol) price -

Gasoline "Breaks on through to the Other Side"

Home again, home again, jiggety-jog. Markets are lower here, guess what, resources again, down over a percent and one quarter. Our economy was rebased, and we managed to eke out a gain, a small one. Sigh, we need to try harder.

Sasha Naryshkine, Byron Lotter and Michael Treherne