Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday morning we received full year results from one of our recommended stocks, Tiger Brands. Before we delve into the numbers let's just reflect on what the share price has done over the last three and a half years. Thanks Google Finance for the below graph.

The performance in recent months has been astonishing. More on that later.

Turnover increased by 11% to R30bn, operating income increased by 15% to R3.6bn and HEPS increased 15% to 1804c. There were of course some once off impairments which we need to clear the air about before we delve deeper. A further impairment of R105 million was implemented on top of the R849 million impairment from the first half of the year for Dangote Mills.

And this was for a business that lost R282 million in the year. It lost R384 million last year so we are seeing an improvement at least. Tiger Brands is working extremely hard to turn this business around but it will take time. Each quarter the loss is decreasing and once the operational side is sorted Tiger will be well positioned, the demographics of Nigeria speaks for itself, we will have to be patient to see the results from this acquisition. Fortunately for us, we are patient investors.

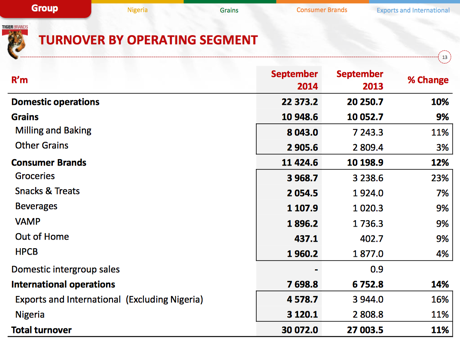

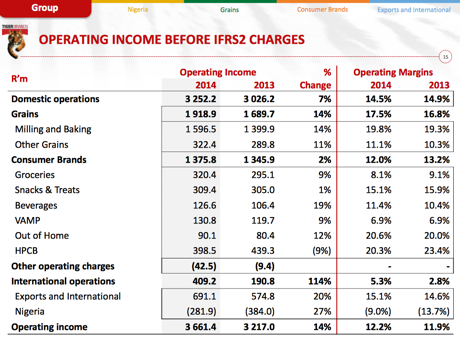

As you can imagine, within the sales of R30bn there are lots of moving parts. I hacked the below two tables from the presentation (Big up to Tiger, their presentations are always great!) which shows you sales and where they make their profits.

As you can see, a solid performance from the grains division. We have seen bumper crops and lower soft commodity prices, that is why margins in this division have increased by 90 basis points. Consumer brands had a tougher period margin wise. This is what happens when you have a weak consumer facing heavy inflation. Their international business excluding Nigeria is doing nicely and contributes a solid 19% to operating income and growing.

Why have we seen such strong performance from the share price? At current levels the share trades at 21 times earnings excluding the impairment one offs. Nestle (24 times), Kraft (18 times) and Mondelez (22 times) all big global food manufacturers trade at similar multiples. Why shouldn't Tiger trade at 21 times earnings then? It is operating as the biggest food producer in Sub Saharan Africa, which is expected to grow collective GDP by 5.8% in 2015. What we have seen here is a rerating in the sector (AVI has also done really well).

Tiger have also come through a very tough period where they have implemented heavy cost cuts making them leaner and meaner. They have pushed their brands hard in order to steal market share during a very competitive period. Tiger Brands are well positioned to benefit from a consumer which has normalised to current prices. As inputs decrease thanks to lower commodity prices Tiger will have more room to expand margins and relieve the consumer with some price decreases. Everyone wins!

I am impressed with these results. Nigeria will take a while, especially with the current pressure from lower oil prices but the rest of the business is in tact. We continue to add.