Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

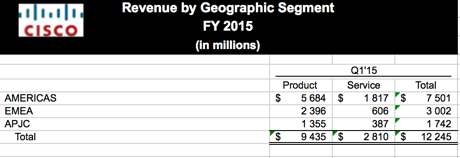

Last week we received results from Cisco for the first quarter of their financial year. It was the best Q1 of their history with revenues of $12.2bn which saw an increase of just 1%. Non-GAAP earnings came in at 54c per share which beat consensus by 1c. Earnings estimates for the full year are expected to come in at $2.13. Trading at $26.47 the stock affords a forward multiple of 12.4. Not expensive by any stretch of the imagination. The company also sits on cash and cash equivalents of $52bn (nearly 40% of its market cap) and has bought back $1bn worth of stock in the quarter with a remaining $7.5bn still to come.

Let's remind ourselves what they do. Simply put Cisco provides the hardware which allows the internet to work. Companies like Vodafone, MTN and AT&T spend billions of Dollars with companies like Cisco to lay down the foundations in order to supply connectivity. Of their revenue mix 77% comes from selling the product while the rest comes from servicing the products they sell. Below is an image of their geographic mix which is pretty well balanced. (EMEA stands for Europe, Middle East and Africa and APJC stands for Asia Pacific, Japan And China).

But why is the stock so cheap? Guidance was disappointing and order growth of 1% is slow. Companies like AT&T have pulled back on capex as the net neutrality debate reared it's ugly head. Why would companies pay to provide faster internet speeds if they cannot charge a premium for it? The industry also comes with strong competition from Asian businesses and weaker emerging market demand. Sometimes having strong international diversification can be a curse, especially when the US economy is where everyone wants to be. These are some of the concerns facing Cisco. But there certainly are some exciting elements.

The concept known as the internet of things is very reliant on Cisco hardware. The internet of things means making all electronic devices "smart". For example fridges, geysers, alarms, TV's. All these household goods getting smarter in order to save energy costs and in general make our lives easier. The business also has incredible margins. Gross margin of 63.3% beat expectations for the quarter of 61.7%. Operating margins were above 29%.

In my humble opinion I do not believe the net neutrality issue will be significant because I do not think it will ever be implemented. The US is too competitive by nature and with a stronger Republican influence I doubt we will see any legislation arise. From the readings I have done on Vodafone, a company who is investing heavily on supplying true 4G connections around Europe I am certainly encouraged. Apparently 4G doubles the demand for data compared to 3G so you can see the attraction for the networks. As smartphones get better and people demand more content (and more data intensive content like HD movies) we should see demand for faster internet.

The short term story is under pressure for Cisco and we also feel the Executive Chair John Chambers has overstayed his welcome. New management could be a breath of fresh air for Cisco. Weighing up the pros and cons mentioned above, I recommend a hold on this stock. Net neutral (excuse the pun).