Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

A company NOT to avoid is one involved in the growing sector of healthcare. You might buy fewer restaurant meals, you may go down in the food stakes to brands of lower quality, heck, South Africans might even eat humble pie and downgrade to a lesser German automobile, the shock and horror of it all. When it comes to your health however, you are almost always inclined to go with the best affordable option, the truth is that the wealthier you are, the more you can spend on quality life saving therapies or procedures. Which is why we like businesses like Mediclinic, that company released their results this morning, for the six months to end 30 September 2014.

The company continues to grow well across all their segments, revenue at a group level grew 19 percent to 16.828 billion Rand, normalised EBITDA was 18 percent better to 3.329 billion Rand, with marginal lower EBIDTA margins at 19.8 percent. Basic normalised HEPS increased 22 percent to 185.2 cents, remembering that the share price is 97.81 ZAR. A dividend of 31 cents (interim) is 11 percent higher than in the prior reporting period. The dividend at the full year stage was 68 cents, an 11 percent or so increase on that is around 75 cents, add the two together, slash off the 15 percent dividend tax and you get to less than a one percent yield. You are not owning this company on the yield, that is for sure.

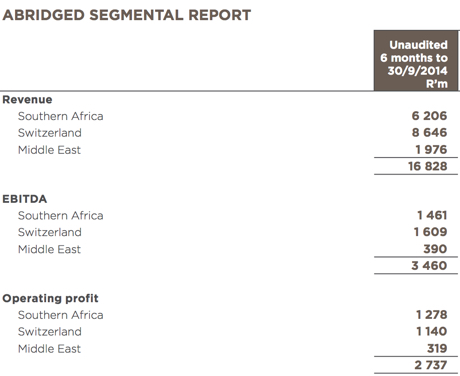

From a geographic point of view, here goes, this is the split:

So, here goes, Southern Africa is 36.9 percent of revenue, it is a much bigger profit generator, 46.7 percent of the group. Obviously from that, you can tell that from a revenue point of view that the group is more an international business, Switzerland is 51.4 percent of revenue, it is however only 41.6 percent of operating profits. The Middle East (all 2 hospitals and 9 clinics) represents a large portion of profits.

Also, if one wants to throw in number of beds here, let me use that opportunity. In the Middle East there are only 383 out of a total of 9669 beds (nearly 4 percent), Southern Africa at nearly (79 percent), Switzerland the balance, 17 percent. So ..... you can quickly see that the kinds of facilities external to South Africa are a lot more profitable, on a per bed basis. On the premise (checking out profits) that not all beds are the same, let us work out operating profits per bed, per region. And then work it out on a day basis, operating profits per bed, per day, per region. Not tricky, just a little math. So, divide the operating profits, per region by the number of beds, by the number of days during the year (half of a year = 182.5 days) and then hey presto, you get a number.

Roughly, Southern Africa is 917 ZAR per bed per day of operating profits on 4 453 Rand of revenue (same basis total revenue per bed per day), in the Middle East each bed generates 4 564 ZAR of operating profits off of 28 270 Rand of sales, in Switzerland the daily bed revenues are 28 712 Rand, with operating profits per bed per day at 3 786. Operating margins are pretty similar right, however costs are obviously much higher where the richer people (as a collective) are, in the Middle East operation and Switzerland.

Of course not all beds are occupied at all times, the occupancy rates for the last six months are as follows, Southern Africa 75.6 percent, Switzerland lower than the prior two full years at 72.3 percent, this is as a result of being measured against the occupancy rates for the full year, the first half in Switzerland coincides with Summer, Winter is a higher period of occupancy for hospitals in Switzerland. True story. I cannot find an occupancy ratio for the UAE/Middle East business. Perhaps too few beds to measure accurately, I should put a question into the people at their investor relations.

Medical healthcare is an emotive business, the users of the service are frustrated, it is after all your life that is being delt with. Nobody wants to be ill, or have any surgery, at least not of the elective kind. If you can be one of the most reliable partners, attract the best talent and continue to offer a better than the state (the alternative) solution, you are well placed. Healthcare is also a necessity for upwardly mobile middle income people, of course it is as much a demographics story as any other. As more people in the developing world move into the middle income brackets, those businesses should continue to expand. As importantly, as richer people live longer, as a result of more expensive therapies, better nutrition and more healthy lifestyles, medical care of the quality kind becomes more important in their lives.

The stock looks expensive, at just under 100 Rand, expensive however for a reason. Whilst the company continues to ramp up their infrastructure (both new facilities and spend on current facilities, hospital equipment is expensive), top line growth should moderate to the mid teens, profits too, earnings per share should be able to reach 6 Rands plus in the next two and a half years. The dividend will still be average at best, this is however a growth company operating increasing in rich countries at scale, most of their customers across their markets are able to afford the quality care. We continue to accumulate the company, buy.