Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Results from L'Oreal yesterday, for their third quarter to end September, the biggest company of their kind on the planet. According to their annual report from 2013, in sales from 2013, this is the spread: L'Oreal: 28.88 billion Dollars, Unilever: 20.70 billion Dollars, Procter & Gamble: 20.08 billion Dollars, Estee Lauder: 9.98 billion and in fifth place, Shiseido: 8.38 billion Dollars. Earlier this year Shiseido sold two brands, Carita as well as Decleor (excuse me for leaving off accents here) to L'Oreal. Smaller in the bigger picture, sizeable nonetheless.

Just a reminder, if you needed one, the major shareholder is the Bettencourt Meyers family, the relatives of founder Eugene Schueller. It is well known that Schueller, a French chemist (as you can see from the surname of German stock), funded a fascist party in France. The party was a Nazi sympathiser, we all know what that means. Schueller had one daughter, Liliane, who inherited the family business when her father died in 1957. Liliane's husband, Andre Bettencourt, was also a member of the same said political party, La Cagoule. Andre was a member of the French government, a cabinet minister. Together they had only one daughter, Francoise, (please don't crucify me for the lack of accents, a publishing nightmare), who is a board member currently.

Francoise is married to Jean-Pierre Meyers, who is also a board member, along with their son Jean-Victor Meyers. Now lean in closely, this is where it gets interesting. Jean-Pierre Meyers's grandparents were killed at Auschwitz, his grandfather was a Rabbi. So the granddaughter of a Nazi sympathiser married the grandson of a Rabbi killed at Auschwitz. Francoise Bettencourt-Meyers is published on Jewish-Christian relations, I guess the story shows that love does really conquer all.

Why is all of this important, the family history? It is important to know who currently controls the company. Which (the shareholding structure) is not as easy to find as you might think. I do know that there are, as of July 2014, 48.5 million less shares in issue. The company bought back the shares from Nestle, long time shareholder at 124.48 Euros a share. Current price as of last evening close in Paris was 124.10 Dollars. The unofficial ADR program (5 for 1) closed at 30.05 Dollars last evening, down four and one quarter of a percent. More on that in a moment.

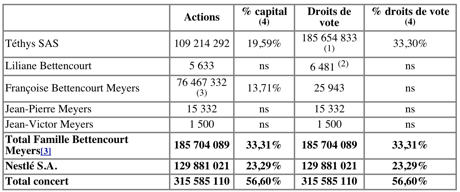

So, the shareholding after the company had bought some of the Nestle shares has been reduced to 560 million shares in total. At 124 Euros that equals a market cap of 69.32 billion Euro, at the current exchange rate of around 1.25 = 86.81 billion Dollars, this is a sizeable company. Here is the breakdown, Tethys SA is Liliane Bettencourt (the courts in France have declared that her daughter has power of attorney), Francoise votes on her own, and Nestle has the reduced stake (recall the story Byron wrote in February -> Nestle make their intentions clear). See here below:

Nestle will of course vote with the family, together as you can see, they now control 56.6 percent of the company, the Bettencourt Meyers family have one third.

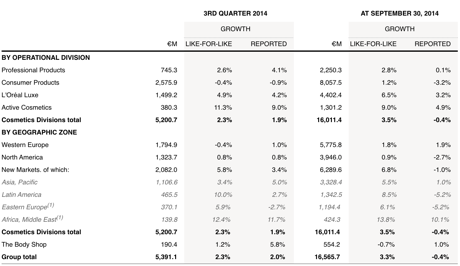

Were the numbers that bad to warrant a four and one quarter of a percent sell off? Perhaps they were, it was certainly a miss, from the perspective of sales. And as this is only an update: Sales: 16.56 billion euros. Gains, very marginal gains though. Here is the table of sales:

These are undoubtably disappointing numbers, there are no two ways about it. I noticed in their annual report that both Argentina and Brazil were big markets of theirs in hair products. I am sure that with many emerging markets, the current pressures are telling on imported products. Just as an aside, Brazil is one of the only territories (as a result of wonderful diversity) that in their hair products all 8 types of hair exists. 8 types? For a more in depth look at their skin and hair types around the world, follow the link.

What to do now? Nothing, in fact I think that this is a massive opportunity. The divergence in the respective share prices, the New York ADR and the Paris listed one are remarkable, from the middle of May onwards this year. That has everything to do with the markedly weaker Euro to the Dollar. The L'Oreal ADR in New York is down 10 percent more than the listed entity in Paris since then! Obviously the Dollar strengthening has not been good for the ADR share price, that makes complete sense. More Americans in Paris I guess this year for Christmas than the other way around.

Stay long, be patient. The company expects quicker sales in the coming quarter. They are still beautifully placed to maintain and take market share in what is an incredibly exciting space. Buy!