"They will do whatever it is that they need to do to stick to their mandate, worrying about it or stressing about it is a waste of effort. Effort that could be spent analysing companies, the decisions that really matter for investors. Rates go up and down, it seems Mr. Market is looking for the unknown on the timing of the first rate hike"

To market, to market to buy a fat pig. The ship has finally sailed. The end of one of the biggest experiments in monetary policy ever. This current bond buying program (Mortgage Backed Securities and Treasury Securities), referred to as QE3, Quantitative Easing (third time), had the curtain come down. Check it out, the second part:

Statement Regarding Purchases of Treasury Securities and Agency Mortgage-Backed Securities. The program ends Friday, Halloween. For some, the size and scale of the Fed program was scarier than Freddy Krueger, Jason, Dracula, Frankenstein, for me it was always Pennywise from the movie adapted to the Stephen King IT. Yes, if something had to be scary, it was that darn clown Pennywise.

You can read the very short Fed statement from their website:

Press Release. You can try and decipher the tone, the new words, the extended words and so on.

"The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run." Only one person on the committee dissenting, Narayana Kocherlakota. Kocherlakota is amazing, the fellow went to Princeton at the age of 15, he had earned a Ph. D in Economics by the time he was 24.

That is the point I often make about the Fed, these people are nothing short of the finest minds and the best people for the job. They will do whatever it is that they need to do to stick to their mandate, worrying about it or stressing about it is a waste of effort. Effort that could be spent analysing companies, the decisions that really matter for investors. Rates go up and down, it seems Mr. Market is looking for the unknown on the timing of the first rate hike, the other question unanswered is whether or not we are in a lower high on the ceiling of interest rates. I mean that in the same way that our landlocked neighbour, Lesotho, has the highest lowest point in the world. The FOMC members will judge on the data as it appears to them. Rates could be low for a while still, that part we know.

Let's watch it, OK?

Last part,

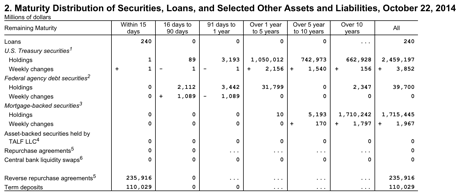

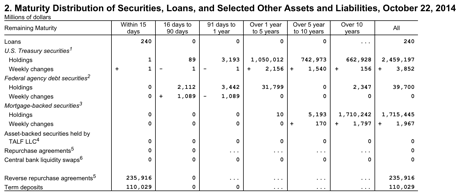

the Fed is not obligated in any way to unwind their balance sheet (nearly 4.5 trillion Dollars) in a hurry. They could of course hold many of the assets to maturity, both the mortgage backed securities and treasuries have the current "maturity distribution":

End of story and a chapter for me. I for one did not see "easy money" falling from the sky, if anything banking regulations tightened and loans were less forthcoming, there was no explosion in money supply to individuals and the business sector.

Hey, what do I know though, right?

Locally the market had enjoyed a cracking day, industrials driving the broader market, Naspers and Aspen both up strongly. It will be some time yet until Anglo American is hauled in by the chasing pack and falls out of the top ten, perhaps not for a while.

At a Rand market cap of 330 billion, and with 10th and next placed (how the mighty have fallen) FirstRand at 257 billion Rand, something needs to change quickly in the pack below. You have Standard Bank at 217 billion Rand market cap (11th), Vodacom at 193 billion (12th) and Aspen Pharma at 171 billion (13th) bigger than Old Mutual, 14th place is worth 160 billion in Rand terms. AngloPlat and Kumba Iron Ore have fallen outside of the upper echelons, AngloPlat now in 20th place.

It gets uglier further down the table, Mr. Price has a bigger market valuation than Impala, 55.4 billion Rand versus 52 billion, with Impala now in 35th place and around one tenth of the size of Naspers. Yowsers. Exxaro is about to slip out of the Top 40, AngloGold Ashanti has already, smaller than Brait or Life Healthcare by a whisker. Coronation and Capitec are bigger than Gold Fields, who nearly falls out of the top 50 and has a market cap of 31 billion Rand. How the mighty have fallen.

A company that has been making good progress in the value stakes, with rising earnings from their older and newer businesses is

Mediclinic, who released a trading statement during the course of the morning yesterday. Basic EPS is expected to be between 12 to 22 percent higher, basic headline earnings per share (HEPS) is expected to be 4 to 14 percent higher for the interim period to end 30 September 2014.

A more detailed idea of once off items are expected to be fleshed out (no pun intended) at the results themselves, which will be released on the 6th of November, which is next Thursday. Excluding certain once offs, basic normalised HEPS is expected to increase between 17 to 27 percent. The ranges are wide and the different reporting methods are confusing at face value, again, all we have to do is to wait for a single week in order to see what progress the company is making outside of the various once off items.

More then!

Things that we are reading, that we think you should be too

A look at how gold has fallen from grace for the "man on the street" investor and how stocks are more popular again -

GLD's Fall From Grace. A point made in the blog post is about mean reversion, the only thing that I would add to his explanation is that mean reversion happens at an aggregate level and not on the level of individual stocks - some companies are just above average and will continue to do better.

The World Bank is saying quality and not quantity -

World Bank urges China to cut economic growth target to seven percent in 2015, focus on reforms. A 7% growth rate is still well above the world average of 3.8%!

The debate about whether QE worked or not, still has many years ahead before it is resolved -

The sun is setting on "quantitative easing" in the US: Did it work?. There is still debate about what got America out of The Great Depression and what could have been done differently. What is clear though is that you would rather be in America's shoes and not the European's -

Europe's Glacial Growth Lowers Prospects for Job Seekers

A lower oil price may not be great for Sasol but it is good for almost everyone else, a lower oil price means that operating costs are lower for companies and consumers will have more money to spend -

OPEC's Badri sees little output change in 2015, says don't panic on oil drop

I hardly noticed that the Post Office was on strike, for some companies that rely on post to conduct everyday operations it was a different storey. The good out of this though is that it has pushed companies to become more electronic.

Update on South African Post Office Operations

Home again, home again, jiggety-jog. Markets are down today, taking a breath after a couple of strong days? Resources stocks are the worst hit, with Kumba down 4%. The Rand still below the R11 mark to the US Dollar but did weaken after the FOMC said that rates may rise sooner than the market expects. Higher interest rates mean more money will flow into the US resulting in a stronger dollar. Talking interest rates, Ben Bernanke said he doesn't expect interest rates to normalise in his life time. So lower interest rates for longer.

Sasha Naryshkine, Byron Lotter and Michael Treherne