Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Given the all the earning figures that have been coming in over the last few weeks, we never gave you the breakdown of one of the bluest blue chips around, GE.

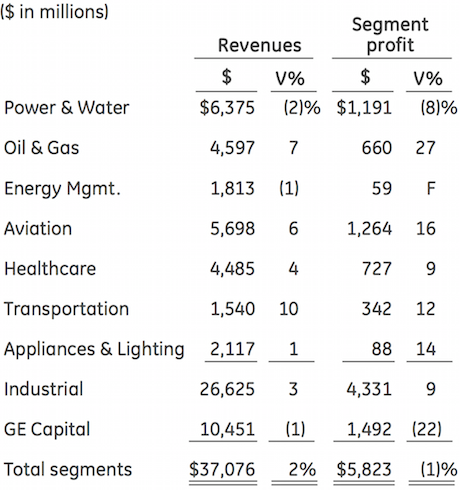

Here is a breakdown of where they are making their money:

Some of the highlights from the results are, EPS is up 6%, margins grew 0.9% to 16.3% and there was organic growth of 5%, with revenue up 1% to $36.2 billion. The company has many moving parts and due a restructuring it is difficult to find and compare like for like numbers. Some of the big moves for the third quarter are the sale of their appliances division to Electrolux and the IPO of one of GE Capitals divisions, Synchrony (up 13% since the IPO). Cash flows for the quarter were 7 billion Dollars, the company used 1.8 of it to buy back shares, earnings accretive in the long run.

The GE strategy is "to be the world's best infrastructure and technology company", part of that strategy is to lower GE Capitals contribution to earnings to 25% by 2016. Given how volatile financial companies can be, I am happy to see a GE Capitals contribution to the bottom line dropping. You will note in the above image that GE Capital's contribution to earnings was 22% lower. The reason given is that there are lower assets (partly due to the IPO of Synchrony) and their tax rate has increased.

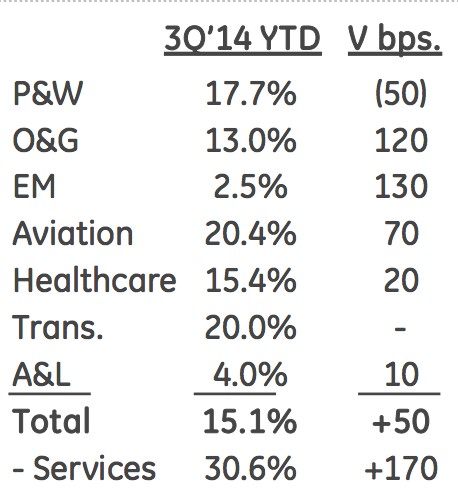

Moving to the Industrial division of the company and the part of the company management talk the most about. Their orders are up 22% compared to the same time last year, with an increase of 25% in the US and 26% increase from China (the two growth engines of the global economy). The division is doing well with most of it's segments increasing margins:

Having a look at the GE home page you can see all the innovations that they are spending money on, particularly on the healthcare front. Here is a link to all of the products that they supply - GE Products.

The company currently trades on a PE of 17, which depending who you speak to could be considered expensive. I feel that the stock is fairly valued, at current levels the dividend is around 3.4%, the forward PE is 14 and not to mention the "safety" from owning such a large and diversified company.