Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Byron beats the streets

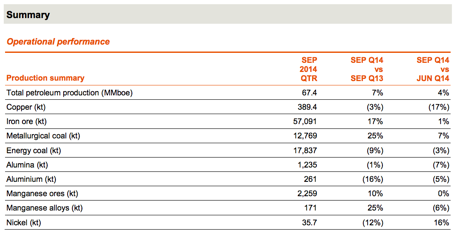

Yesterday we received a production update from our favoured entry into the commodities space, BHP Billiton. Here is the table hacked from the presentation.

Iron Ore and Petroleum are the big ones to watch because they are responsible for the majority of the companies profits. Clearly the company is doing everything it can and doing it well. Production is in the hands of the company, commodity prices are unfortunately not. Overall production across the whole group was up 9% as the business achieved records across 8 operations and 4 commodities.

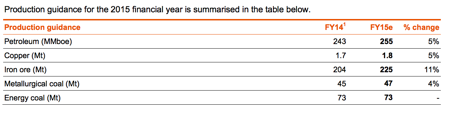

And as for 2015, ambitions are high to maintain this production growth off an ever higher base. Here is what the company expects.

Investing in miners is a tricky business because the underlying prices of their products are so volatile. What can be controlled however is production and the make up of your portfolio. For instance where to mine, what to mine and how to mine it. We feel that BHP are by far the best positioned in their commodity mix as well as their asset selection (the mines they operate).

But where are commodity prices going? I have read a few reports suggesting that we are reaching a "new normal" so to say as the Chinese industrial revolution starts to taper. I agree with that to a certain extent. The Boom days of the last decade as far as China is concerned may be a thing of the past and the huge ramp up in production to try and benefit from all the demand has meant huge supply with slowing demand. That of course leads to price decreases.

The Chinese story is a unique one and we'll never see anything like it again. But don't forget that India as well as the majority of Africa still have huge infrastructure requirements. As well as many other places in the developing world. The key to investing in this sector is to find the right mix with low cost production and high margins, even at lower prices. Billiton fits this bill.

Historically copper demand increases as a country becomes more developed. This makes sense, wealthier people require more electricity. On the same premise so does the demand for energy (oil and gas) and food (potash). Iron ore may taper out but these good things cannot last forever. Billiton's Western Australian assets are fantastic and will continue to produce profits at current price levels.

On this basis, as well as the encouraging production report noted above, we continue to hold Billiton in our portfolios. However we wouldn't encourage an allocation of more than 10%. If you are concerned about your Billiton weighting send us a mail to discuss rebalancing options.