"And it is about Nigeria, where (as per the release), there was Constrained subscriber growth ... as a result of regulatory pressure. Continued unrest in the northern part of the country and indeed the aforementioned pressures as a result of a "dominant operator" ruling in Nigeria, saw a modest decrease in the subscriber base of around 85 thousand customers to 58.363 million."

To market, to market to buy a fat pig. Ummmm ... I read a headline that investors were worried as a result of shots fired in the Canadian capital, Ottawa, at the parliamentary buildings. I guess this is no matter to be taken lightly, for Cpl. Nathan Frank Cirillo and his family it is the end of the world. All he was doing was guarding the tomb of the unknown soldier, a War Memorial, and by guarding I mean standing unarmed. He was shot by some crazy person, who had multiple drug related charges ->

Alleged Ottawa shooter apparently had criminal past in Quebec, was repeatedly brought in on drug charges. Sigh. Guns and unstable people, we know more than a little about that in these parts.

I guess the long and the short is that if you get someone who can get that close to one of the leaders of the world, who presides over the 13th largest economy on the planet, that is cause for some concern. Earnings ultimately set the levels, Boeing took some heat yesterday, the stock was down nearly four and a half percent. In the end, the Dow was down in the second half of the session, down by 0.92 percent. The broader market S&P 500 lost three quarters of a percent on the day, well over one percent on the day from the high point.

Why was Boeing down so much? The results themselves ->

Boeing Reports Strong Third-Quarter Results and Raises 2014 EPS Guidance, were actually decent, the problems were the increasing cost of the new flagship product, the Dreamliner program costs are rising rapidly.

Still, during the period in question (the three months) Boeing managed to deliver 120 737's, 6 747's, 2 767's, 27 777's and 31 of the aforementioned 787 Dreamliner models, commercial aircraft delivered for the 90 day period was 186. Or more than two a day. Remember that Boeing also has a defence arm, they delivered 46 military aircraft, one Boeing 737 AEW&C as well as a single commercial/civil satellite. They make a lot of objects that fly, mostly passenger jets, and mostly the short haul stuff. Recently I saw that there were moves afoot to increase the manufacture of the 737's from 42 to 52 a month, citing increasing demand from the East.

Indeed, you can see in the IATA numbers (84 percent of all airlines) in their last annual report ->

Annual Review 2014, that there were roughly double the number of airline passengers from 1998 (1,471,000,000) to 2011 (2,824,000,000).

According to the same said report, airlines carry 8.6 million people daily and conduct 99,700 flights a day. Almost every flight is incident free. I wish I could say the same for the roads. Boeing certainly looks like they have a bright future, look at a more recent IATA release:

New IATA Passenger Forecast Reveals Fast-Growing Markets of the Future. Yowsers, the skies are going to be fill, 7.3 billion passengers a year expected in 2034!

MTN released their quarterly update for the three months to end September 2014. You can download them here ->

MTN Group records 219,2 million subscribers. The highlights points include genuine highlights such as a 2 percent quarter on quarter increase in subscriber numbers, from 214.96 million subscribers at the end of June to 219.19 million subscribers as at the end of September.

Data is still on fire, from a growth point of a view,

growing 34 percent year on year and now contributes 17.8 percent of total revenues.

Also included in the highlights reel is that the number of registered Mobile Money subscribers increased over 20 percent quarter on quarter, and now numbers 22.2 million, or around 10 percent of the number of subscribers. Another highlight is the recovery of the local market, the original market, South Africa, which saw the addition of 1.4 million subscribers, most of those in the prepaid segment, up 7.1 percent there. 21.224 million subscribers in the prepaid market for MTN in South Africa. Nice recovery in the South African markets, the local ARPU's continue to fall, down 5.1 percent Rand quarter on quarter. In US Dollars it was down 4.9 percent, local ARPU's that is.

In Iran, 3G services were launched (I swear to you I saw someone on my timeline feed retweet the

Ayatollah Khamenei's feed, even though Twitter is banned in Iran), the positive impact was a local currency 102.8 percent jump in data revenue. Notwithstanding that massive jump, Dollar ARPU's were 2 percent lower quarter on quarter.

And then something in the highlights package that looks more like it should be in the lowlights package. It is there nonetheless. And it is about Nigeria, where (as per the release), there was

Constrained subscriber growth ... as a result of regulatory pressure. Continued unrest in the northern part of the country and indeed the aforementioned pressures as a result of a "dominant operator" ruling in Nigeria, saw a modest decrease in the subscriber base of around 85 thousand customers to 58.363 million. As you can see, this (Nigeria) is their biggest market, in second place is Iran with 43.5 million and of course South Africa (total base) is 26.7 million.

Interestingly ARPU's in Nigeria went sideways! In Dollar terms it registered a 6.91 Dollars per user per month in the last quarter, relative to the prior quarter where it was 6.92 Dollars.

Traditionally for all the markets the fourth quarter is where the ARPU's are the strongest, it makes sense, you speak to your loved ones more during the end of year period.

The net subscriber additions for the year was adjusted marginally higher to 17.5 million. Nigeria expected to add 3.5 million of those, revised downwards from 5 million. South African, Cameroon and Iran numbers also revised marginally higher, Cameroon the biggest amongst those.

The market I guess is concerned with the largest territory, Nigeria registering a modest subscriber loss due to the dominant position that the business has in that specific market. The stock is down two percent on the news. We continue to expect that whilst ARPU's are sliding that the continued additions to the networks of subscribers, as well as increasingly more services, better handsets and more applications, MTN will still continue to grow their profits in the low teens for the next few years, better and better dividend payments are expected,

the stock yields around 5 percent pre-tax forward.

Visa announced yesterday that they will

increase dividend rate by 20%, raising the annual payout to 1.92 Dollars a share. On a share price of 212 Dollars that is around 0.91 percent, pre tax. A two year treasury note yields 0.38 percent. One is supposed to be safe as houses and the other is a growing business in the more than a little exciting area of electronic payments. Results are next week, after the market closes on the 29th of October.

Byron beats the streets

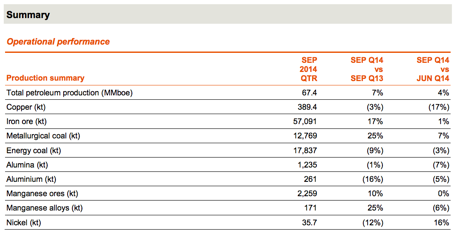

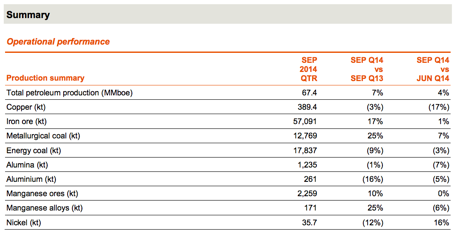

Yesterday we received a production update from our favoured entry into the commodities space, BHP Billiton. Here is the table hacked from the presentation.

Iron Ore and Petroleum are the big ones to watch because they are responsible for the majority of the companies profits. Clearly the company is doing everything it can and doing it well. Production is in the hands of the company, commodity prices are unfortunately not. Overall production across the whole group was up 9% as the business achieved records across 8 operations and 4 commodities.

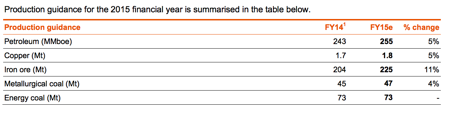

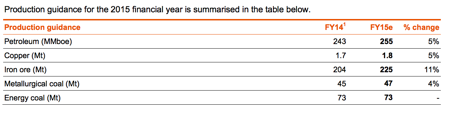

And as for 2015, ambitions are high to maintain this production growth off an ever higher base. Here is what the company expects.

Investing in miners is a tricky business because the underlying prices of their products are so volatile. What can be controlled however is production and the make up of your portfolio. For instance where to mine, what to mine and how to mine it. We feel that BHP are by far the best positioned in their commodity mix as well as their asset selection (the mines they operate).

But where are commodity prices going? I have read a few reports suggesting that we are reaching a "new normal" so to say as the Chinese industrial revolution starts to taper. I agree with that to a certain extent. The Boom days of the last decade as far as China is concerned may be a thing of the past and the huge ramp up in production to try and benefit from all the demand has meant huge supply with slowing demand. That of course leads to price decreases.

The Chinese story is a unique one and we'll never see anything like it again. But don't forget that India as well as the majority of Africa still have huge infrastructure requirements. As well as many other places in the developing world. The key to investing in this sector is to find the right mix with low cost production and high margins, even at lower prices. Billiton fits this bill.

Historically copper demand increases as a country becomes more developed. This makes sense, wealthier people require more electricity. On the same premise so does the demand for energy (oil and gas) and food (potash). Iron ore may taper out but these good things cannot last forever. Billiton's Western Australian assets are fantastic and will continue to produce profits at current price levels.

On this basis, as well as the encouraging production report noted above, we continue to hold Billiton in our portfolios.

However we wouldn't encourage an allocation of more than 10%. If you are concerned about your Billiton weighting send us a mail to discuss rebalancing options.

Michael's musings: Minister Nene gets a hospital pass

Yesterday was the Medium term budget speech and the first for our new Finance minister, Nhlanhla Nene. As far as tough speeches go this one is right up there given the backdrop of us only growing at 1.4% this year (forecast was for 2.7%) and a growing debt burden from our large budget deficits.

With our rising interest costs, which government hopes will plateau at around R 150 billion a year (9.3% of the budget) in 2017/2018, Minister Nene didn't have much wriggle room. Less spending on non-core objectives, doing more with less and raising taxes was the message from the speech.

The most emotive issue for rich people is the almost certain raising of taxes next year. The two differing views are, government spending is vital for economic growth as opposed to, governments are inefficient and they waste the money they collect from taxes. I'm not thrilled about having to pay more tax next year, what makes it hurt more is that roughly speaking it would take me around 50 lifetimes of paying tax to pay for our presidents newly built house.

A positive from the speech is that expenditure has been revised down going forward, which will help in reducing our budget deficit. Part of the plan is to freeze governments head count and to only grant increases of inflation. My two concerns with this plan is that government has been the one doing all the hiring recently, the private sector has not been adding jobs, so there will be pressure to add jobs if our unemployment rate starts climbing. My second concern is that I think it will be difficult to get government employees to accept an increase of 6%.

Another positive is that support for parastatals will not come from an increased budget deficit, it will have to come from selling non-core assets. There has been no indication yet which assets they would sell, rumours are though that it could be their stakes in Telkom and Vodacom. A case of throwing good money after bad?

Over the next 3 years government will have to borrow around R 790 billion, most of that will be new debt, with R 194 billion being re-financing of existing debt. That is a very large number and a mention is made to the large re-financing that will be required in 2018 onwards due to debt taken on by government during the financial crisis, which was used to continue their spending. A big concern for me is that our debt status is one notch above junk status, if we get another downgrade it will make it difficult and expensive to raise the required money.

Given what I have written so far it is clear that the finance minister does not have an easy job. The message is clear, government needs to be more efficient with the resources that they have and more will be done to clamp down on wasteful expenditure. Whichever direction government goes though, business will find a way to make money for their shareholders.

Things that we are reading, that we think you should be too

The cost of being a modern CEO -

Death on a Moscow Runway: The Modern, Homeless CEO. Working 100 hour weeks is one of the reasons that shareholders are willing to pay CEO's for what they do.

When the worlds biggest economy is moving in the right direction, that is good news for everyone -

Anyone who says the US economy is getting weaker is completely wrong.

Another thought provoking piece from Crossing Wall Street -

Competition and Monopolies

Home again, home again, jiggety-jog. I suppose that you may be all budget speeched out, the real juicy details on state disinvestments and higher tax rates will no doubt be revealed next year in February. I noticed that there were better than anticipated PMI data from Europe (bar for France), worse than anticipated retail sales from the UK. US consumer confidence and PMI data will be key later, obviously earnings still continue to hog the spotlight. Locally we have seen production numbers from Kumba, Anglo Plat and of course parent company Anglo American. Clicks results too. Busy on all fronts.

Sasha Naryshkine, Byron Lotter and Michael Treherne