Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Ali Baba, at least the original one from the book, Ali Baba and the forty thieves, was a poor woodcutter, the brother of a fellow by the name of Cassim, who had married into wealth. It must have been tough for Ali. Ali Baba stumbled across forty thieves and their magic command to enter a cave full of wonders, the term "open, sesame" comes from the story. Cassim gets to the cave, remembers sesame on the way in and not the way out and gets killed by the thieves. The story ends well for Ali, he manages to somehow thwart the thieves and the captain and uses the gold for himself and his family for the rest of his days.

Jack Ma is not a poor woodcutter, or Ma Yun if you prefer the Chinese name. He (Ma) is the founder of Alibaba. He struck gold himself. Ma was born in the east of China, near the coast in a city named Hangzhou. Wiki suggests that he used to travel for 45 minutes on his bike to get to a hotel in order to converse with foreigners, teaching himself English and eventually acting as a tour guide. He became an English teacher and eventually lectured at a local university in the subject that he had majored in, English. Jack Ma the English teacher became internet pioneer in the early days, building websites such as China Yellowpages back in 1995, again, according to the Wiki entry on Jack Ma, he was first with a major website in China of this size and scale.

Alibaba was founded in 1999, in the DotCom boom, the whole idea was to build a business to business marketplace. Along the way to this point, this day, when the company will list in the US, Ma added a whole lot of other businesses inside his empire. He has just celebrated his 50th birthday, just over a week ago and what better way to do it than by listing the business that he founded 15 years ago.

Last evening the company finally priced, after a lengthy road show. At the top end of the revised range, 68 Dollars a share. The company will start trading, as anticipated, today. 320 million shares at 68 Dollars a share equals 21.77 billion Dollars raised (after all costs and sundries I think). That means, at that price of 68 Dollars, the company will have a market value of 168 billion Dollars. Bigger than Amazon.com.

Imagine that. Not just bigger than Amazon.com, bigger than most businesses, I read a WSJ article that it would now fall into the top 40 companies by market cap globally. So how do they stack up, what are their revenues and profits, now that we know their size and share price? The share code is BABA.

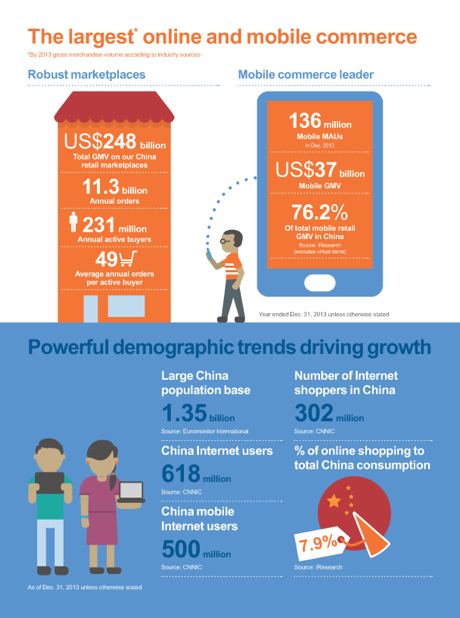

Where do you find all of the core data to make a serious call on Alibaba as an investment? Look no further than the prospectus: Alibaba Group Holding Limited REGISTRATION STATEMENT with the SEC. That is always a very good starting place, and in fact a lot of these numbers are old already, to December 2013. Some of the graphics in the listing document are worth reproducing here, just to once again confirm that for many businesses and in particular businesses like Alibaba and Tencent, the pure demographics story is simply astounding. Here goes, first piece:

And the numbers? The "stuff" that matters to investors? For starters, two thirds of the 320 million shares offered were from insiders, meaning that only 107 million new shares were floated or 13 percent of the shares in issue (at 320 million). The last quarter to June saw Alibaba's revenue surge 46 percent (yowsers), 84 cents of earnings per share. Net income of 1.99 billion for the quarter. At 68 Dollars (there is a little dilution of course), annualise that and you get to somewhere around 330 US cents of earnings. Cheap at 68 Dollars? No wonder everyone was pounding the door down.

And the shareholders? Who is still left? Softbank did not sell any, they will be the biggest shareholder with around 32 percent or 54.2 billion Dollars worth. According to the IPO document, they (Softbank) paid 30 million Dollars for the stake. WHAT? How? Not too dissimilar to Naspers, check: "In 2000, a group of investors led by SoftBank invested US$20 million in our company. In 2003, we established a joint venture with SoftBank for the development of the predecessor entity of Taobao Marketplace. Through a series of investments totalling US$50 million, SoftBank subscribed for shares in the Taobao predecessor entity. In 2003, SoftBank purchased US$30 million in our convertible notes, which SoftBank subsequently converted into our ordinary shares."

Yahoo bought 40 percent back in 2005 (for 1 billion Dollars in cash), Alibaba bought back 523 million shares for 7.082 billion Dollars in 2012. If 320 million shares are 13 percent of shares in issue, then there are roughly 2460 million shares. So Yahoo sold roughly 21 percent for 7 billion, if they had stuck around for another two years until listing that stake would be worth another 26.5 billion Dollars. Wow. Yahoo are selling some more shares in the process of the listing, freeing up another 8 billion Dollars and reducing their stake to 16.3 percent. Or around 27.4 billion Dollars at the IPO price. Don't feel sorry for Yahoo, they are comfortably ahead still! Jack Ma himself will be worth in the region of 13.1 billion Dollars (according to the WSJ), the other founder Joseph Tsai will be worth 5.4 billion Dollars. Good for them.

Expectations from the underwriters (with an option to take up 48 million more shares) is for a ten to fifteen percent pop. I think more. We shall see, do not expect the price to open immediately, there will be a delay and an auction, that is how I remember the prior IPO's. In other words, it does not happen immediately at the open. All fun! As I said, for now our only interest in this IPO is our investments in businesses in China, ones operating in similar places, Tencent and others that are selling to richer people, companies like Richemont.