Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

How are "things" in China? Well I guess the recent softness in the luxury trade, evident through all of the luxury goods producers numbers (including Richemont), as well as the reported lower manufacturing numbers. At the same time housing progress is cooling, the building is slower and inventory (housing) is building, excuse the pun. So what do you do in this case? I suspect that most folks are unable to grasp the ability of an ever growing economy to grow at the same rate. That is why the newer Chinese "goal" of around 7.5 percent, relative to the double digit growth of the prior years sounds "soft". Remember however that 10 percent on 50 units is much less than 7.5 percent on 100 units.

I prefer to see companies and their ability to forecast, based on the clients that they have. That is more important, right? BHP Billiton in a very interesting presentation of one of their really important businesses: IRON ORE BRIEFING AND WESTERN AUSTRALIA IRON ORE SITE TOUR. Here are a few juicy bits extracted:

"We continue to see healthy demand growth for iron ore in the mid-term as Chinese steel production is expected to increase by approximately 25 per cent to between 1.0 and 1.1 billion tonnes in the early to mid-2020s" And "Meanwhile, steel production growth in other emerging economies is outpacing China as those nations urbanise and industrialise. We expect to see a compound annual growth rate for global steel production of between 2.5 and 3.0 per cent between now and 2030."

Obviously this presentation and visit is in response to a lower iron ore price, which has been crushed this year. Remember that BHP Billiton are busy visiting the idea of a higher scale and higher class portfolio, slimmed down by unbundling anything that is non core. If you scroll down the portfolio, you get a chance to see the portfolio split in pictures.

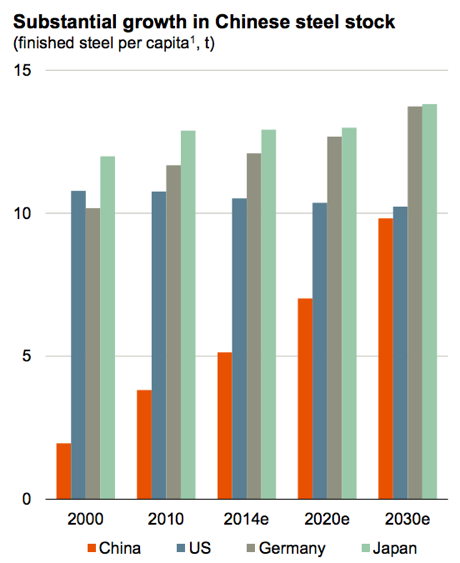

More importantly though, seeing as WAIO (the Western Australian Iron Ore business) is a major contributor to the business and has been wildly profitable, the company has obviously been less focused on cost savings and rather been pushing production at a breakneck speed, higher volumes at seemingly higher and higher prices = no worries. All of that is about to change, with a stronger focus now on costs. Most importantly for you the shareholder however is that BHP Billiton will continue to be one of the lowest cost producers in an environment that sees demand increase. Last graphic here, Steel consumption per capita, two graphs, we roll that out from time to time:

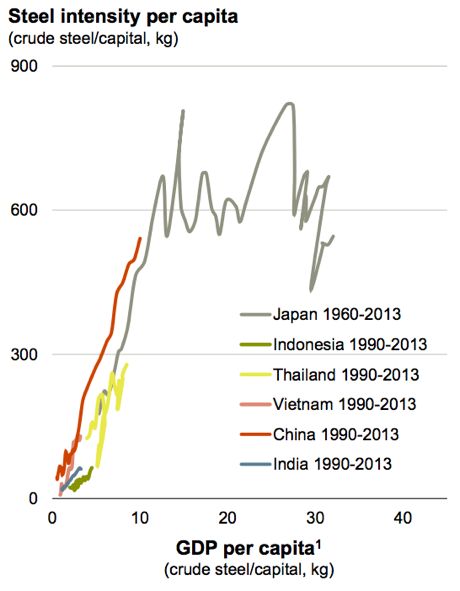

And then look at this one, with the emerging Asian economies.

If the projections by the BHP Billiton internal folks are right, steel demand will continue to be strong and what will matter in the very medium term is how you are able to compete relative to your industry peers. A friend of mine sent me a list of London AIM listed iron ore minors and the story is one of great hope to absolute despair, the road to ruin. With the majors however, their long life quality assets are the only way to be reliably invested for a longer period of time. We continue to hold BHP Billiton.