Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

BHP Billiton released their annual report last week, towards the end and we get a chance to have a look at the business. Remember also at the same time the letter from the Chairman fleshed out a little more the proposed de-merger of none core assets, or splitting of the portfolio, whatever it is that you want to call it. Firstly, the 2014 annual report, follow the link to download it.

There are some juicy bits in the introductory parts, explaining how iron and steel making are important in developing economies, when steel intensity starts to plateau, how copper becomes more important and then lastly how incomes rising equals greater need for food and by extension agricultural products. Of course through the entire stages here energy is important. The one fact that I found mind blowing was that in BHP Billiton's opinion: in the next 20 years, we expect 1.7 billion people to gain access to electricity for the first time. Energy demand is expected to increase 30 percent in the next two decades, most of that from Asia (two-thirds), half of that from China and India alone. I suppose when one in three people around the world come from those countries, that should be expected.

Whilst profits for 2014 were lower than 2012 and 2011, they managed to bounce off 2013 lows, the dividend has increased every year over the last five. Attributable profit clocked 13.8 billion Dollars, net cash flows topped 25 billion Dollars, 25.4 to be precise. The full year dividend was 121 US cents, which was a modest increase on the prior year. In Rand terms however the payouts have been better, the weakening currency is a double edged sword.

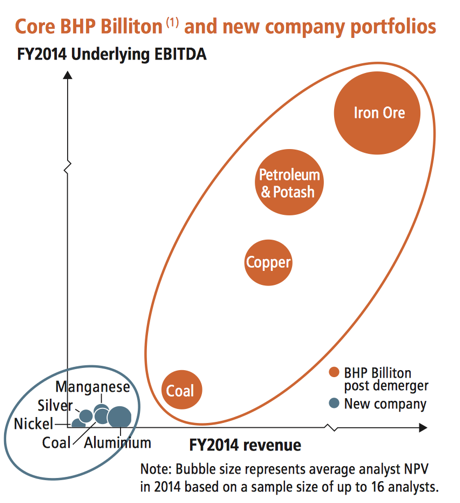

The de-merger gets a whole segment in the annual report, proposed of course. The company wants to have the new entity that is spun off with the noncore assets, aluminium, coal, manganese, nickel and silver and the core assets of iron ore, copper, coal, petroleum and potash to remain. As I understand it, from a location point of view, the noncore assets will be more than half of all the existing operations. Yet they only produced 4 percent of all EBIT, meaning that their profitability is really low compared to the long life high quality assets. Here is a *nice* graphic from the annual report on what the portfolio would look like:

Someone who is a smaller operator can probably sweat these assets a whole lot better than a group that is traditionally high quality, geographically stable. There is a misconception that they are de-Southafricanising themselves. If there is such a word. In South Africa there is a single Aluminium smelter at Richards Bay, Manganese assets in Hotazel and various energy coal assets here, as well as a corporate office. These noncore assets are potentially worth 17 billion Dollars by some measures, the company points out that they have sold 6.7 billion Dollars worth of assets at attractive prices over the last two years, the process was underway any how! Post a demerger, shareholders of the existing structure could expect the same or higher dividend payouts, with the higher quality assets.

So what to do about owning BHP Billiton? I would say that they look cheap, cheap for a reason. There is major uncertainty about commodity prices, I suspect that demand is just fine and specifically for iron, more so copper and lastly energy will continue to expand. Cleaner energy, in particular gas. There are more of us to feed, agricultural commodities will be more and more important. The pay outs are going to continue, the volumes should continue to grow and prices will definitely find a bottom, specifically iron. I suspect we may be in for a rocky two years, the dividend underpin (4.23 percent historic) in a low rate environment should see the share price stabilise too. What to do with the "other" company, post a proposed demerger is a separate question altogether. This company is the number one quality commodity producer in our minds, and the only one that you should own.