Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Just did it, again and again. Nike that is. The company released their numbers last evening after the market closed, this is for their first quarter of their 2015 financial year. Revenues grew 15 percent to 8 billion Dollars, all product lines growing nicely apart from the Action Sports and Golf. Last year in the US, there was a net loss of 143.5 courses. It was the 8th successive year in a row that the trend had indicated the sport was losing traction.

The National Golf foundation of America said that there was a net loss of 400,000 active players, most of that being men, women are actually joining the game en masse. The category that lost the most participants was the 18-34 category. Last year there were the fewest rounds recorded by all active participants (462 million rounds) since 1995. Still, there are 14,564 courses in America and around 24.1 million folks that take part. That number is down from 29.8 million participants (2000) and 15,207 courses (2005), so it is not just Nike losing in a specific sport, everyone is sucking wind. Golf is both time consuming and expensive, most importantly golf courses and housing estates were built at too rapid a rate, expect this number to continue to fall. If you do not want the summarised bit, feel free to pay for more information at the National Golf Foundation's website.

So people participate more in other sports. Nike are both innovative and attract the right audience, who are fiercely brand loyal. You would not be that brand loyal if your product was not both attractive and in this case extremely comfortable and wearable. The innovation in footwear boggles the mind, I have been a wearer of their running shoes for over 15 years and the changes are tremendous. The shoes are lighter, just as durable, more comfortable and they actually look better too! OK, I have to admit that I have a pair of pink Nike Flyknit Lunar. I gave them up for a black pair when I went through a piece of glass on an early morning run!! They still work, with their hole, not as well as before.

Enough about me and my usage as a customer, I am a cheapskate and when I was at the Niketown store in New York recently I refused to spend on myself, that is a personality trait inherited from the older generations methinks. That store is incredible. It is as much a place where the new tech is floated as it is a place where technology meets retail. You can pick a shoe, the stock is checked on an iPhone application, in which the hardware (the iPhone) is plugged into the retail add on. The stock then comes from the basement, once tried on you can pay for them right there and then, the iPhone and the added hardware doubles as a payment device, the invoice is emailed to you. It is a bit mind blowing to see the innovation and product diversity all under one roof on five stories.

The numbers in brief before we lose focus. The margins are eye watering, gross margins expanded 170 basis points to 46.4 percent. Gross profits increased 19 percent to 3.721 billion Dollars, on revenues of 7.982 billion (nearly 8). Net income grew 23 percent to 962 million Dollars, fewer shares in issue (as a result of the buybacks) translated to basic EPS growing 26 percent to 1.11 Dollars a share. There are roughly three percent fewer shares in issue now than there were this time last year. The current quarterly dividend is 24 US cents per share, the last 11 years have seen the dividend increase. Nike have also done two stock splits in the last 8 years, one in April 2007 and another in December of 2012. Over that period the stock is up an incredible 300 percent. Why? Those answers are ongoing.

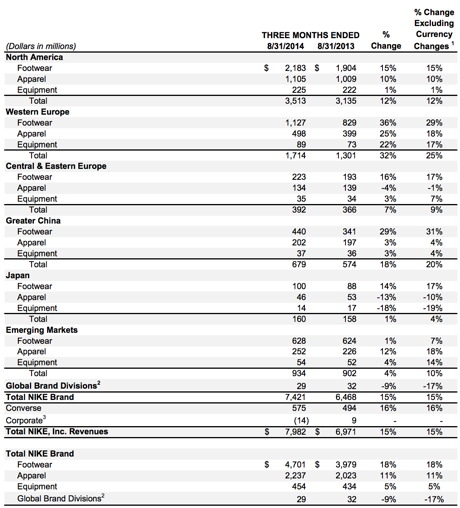

On a geographic basis, nothing better than a table to show you that rich people, folks in North America and Europe have been driving global sales and people wanting to wear more branded products as leisure wear. Sporting apparel, be that your favourite football team's replica shirt, or simply a sweat shirt or tracksuit top, that passes for normal wear these days. The bigger the branding on the front, the better. Here goes, a breakdown of sales across all their regions across all their products categories.

On the conference call -> PREPARED REMARKS / UNOFFICIAL TRANSCRIPT – Q115 NIKE, Inc. CEO Mark Parker said the following about their strong brand awareness: "First, our relationships with athletes and consumers are unparalleled. By relentlessly focusing on what they want and need, we propel our business forward. We use the insights we gain to deliver the products, services and experiences athletes and consumers want."

Roger Federer was amazingly kitted out at the last major in New York, the limited production shoes were sold out before he had even beaten his unranked opponent according to this Bloomberg article: Nike's Genius Michael Jordan-Roger Federer Mashup. The comments from the sportswear analysts about the strong tennis push is looking for more lifetime customers, using the example of not seeing a lot of silver haired guys in the Foot Locker basketball shoes segment. i.e. The older you get, the more likely you are to gravitate towards lifestyle sports. Talking Roger Federer, this is quite cute: Roger Federer Asks Fans To Photoshop Him Around India & The Result Is Hilarious

The World Cup football helped a lot, it is a pity that one of their teams did not win, it would be a coup of epic proportions if the German team was sponsored by Nike. That is not going to happen. Nike boots were worn by more folks on the pitch than all the other brands combined, one-third of all players wore Flyknit boots. Innovation and comfort. One of their other growth segments propelling these results forward was greater China, revenue up 18 percent, EBIT up a whopping 28 percent. Sportswear. Basketball and Running. Those were the categories driving sales. Emerging markets were actually a drag, sales increasing only modestly and EBIT down 26 percent, huge marketing expenses around the World Cup and of course foreign exchange headwinds.

Guidance on the conference call for the full year sees the company expect low double digit revenue growth (12-14 percent is my guess), gross margins are expected to grow by 125 to 150 basis points and EPS growth for the full year is around 20 percent, should the currency not change too materially. Nice -> Nike. The company is a little more than halfway through their 8 billion Dollar buyback, having bought 4.2 billion. 10.6 million shares at 67.74 Dollars a share.

At the post market surge price of 85.60 Dollars (up 7.34 percent) the stock trades on a forward multiple of around 23 times, if you expect around 3.70 Dollars worth of earnings in the 2015 financial year. That, in our opinion is not expensive for a company that is expected to grow earnings over the next two to three years at above and around 15 percent per annum. Buy.