Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

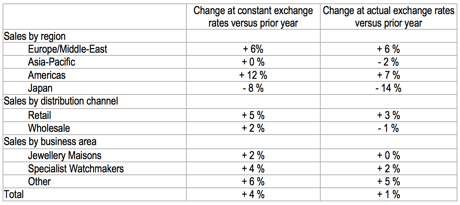

Richemont have released a five month sales report on the same day as their AGM, at first glance and according to the Twitter people it is a miss in analyst expectations. After a long period of very strong growth, both the currency and the local environment in which they operate in have weakened. Here is the table from the sales release:

Sloppy in Asia Pacific and most especially soggy in Japan, post the hike of the sales tax in Japan which has had a marked impact. The commentary has some bright spots however, the Americas have made a comeback and the Middle East is strong: